KCSE BASED BUSINESS STUDIES QUESTIONS WITH ANSWERS

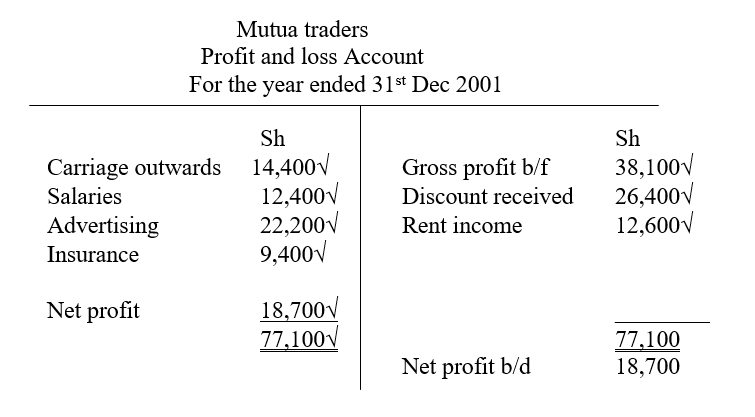

The following balance were extracted from the books of Mutua Traders for the year ended 31st Dec 2001 after having prepared a trading accountDr (sh) Cr(sh) Gross profit 38,100 Stock (31st Dec) 80,200 Cash 105,060 Motor van 603,000 Capital 653,560 Equipment 200,600 Furniture 94,400 Creditors 74,300 Debtors 75,900 Discount received 26,400 Salaries 12,400 Carriage outward 14,400 Rent income 12,600 Advertising 22,200 Insurance 9,400

1,217,560 1,217,560 Required: i) Prepare a profit and a loss account for Fundi Traders for the year ended 31st December 2001ii) Prepare a balance sheet as at 31st December 2011

0 Comments

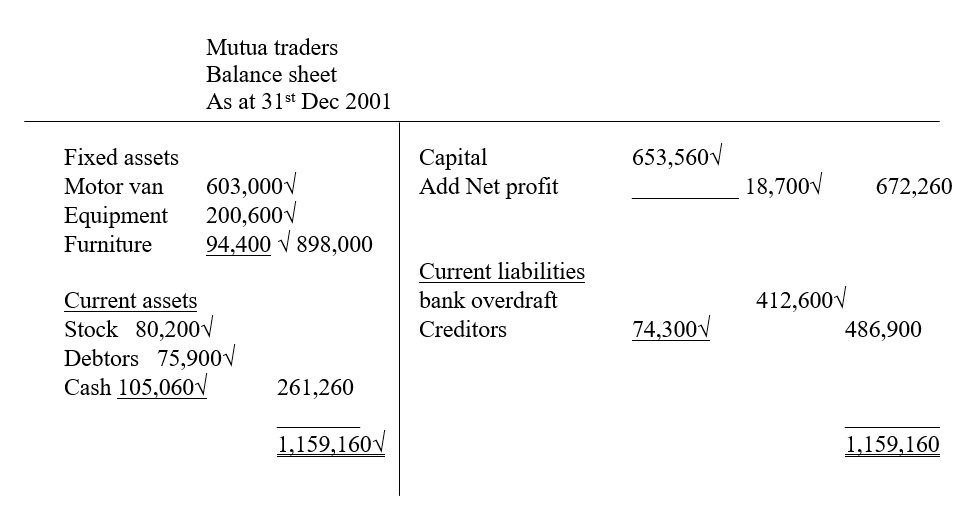

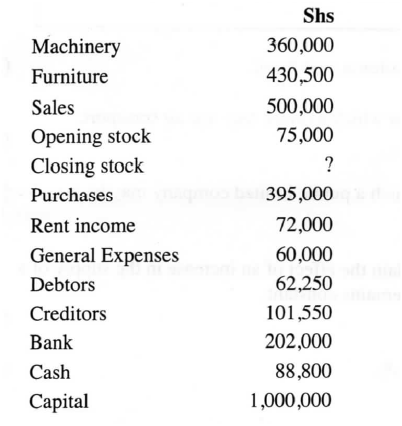

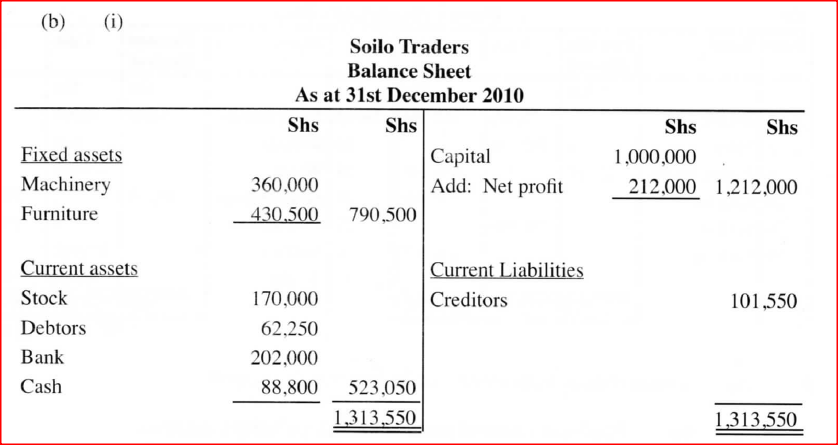

The following balances were extracted from the books of Soilo Traders on 31 December 2010.21/12/2020 The following balances were extracted from the books of Soilo Traders on 31 December 2010.

Additional information:

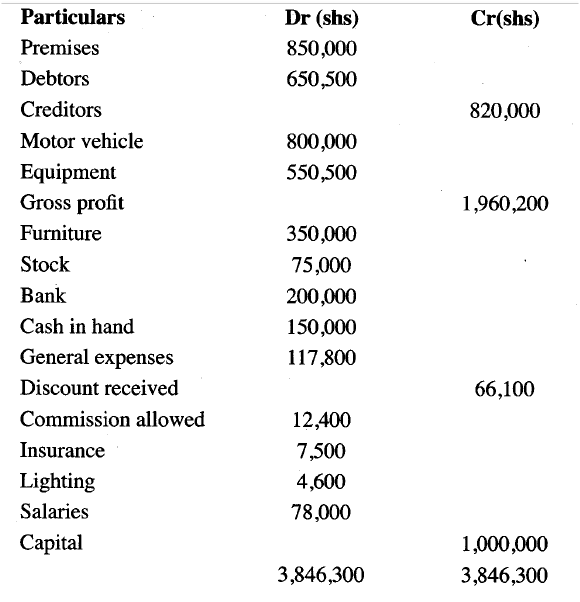

Gross profit margin is stated at 40%. Prepare: (i) Trading, Profit and Loss Account for the year ended 3Pt December 2010. (5+ marks) (ii) Balance sheet as at 3P’ December 2010. The following Trial Balance was prepared by Laketi Traders on 31 December, 2009.

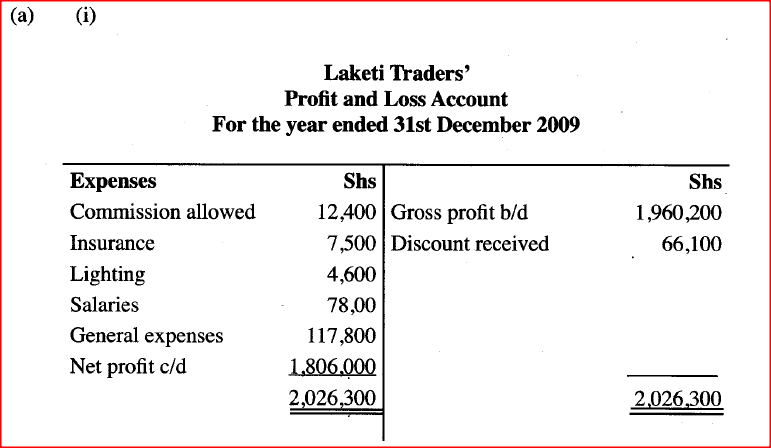

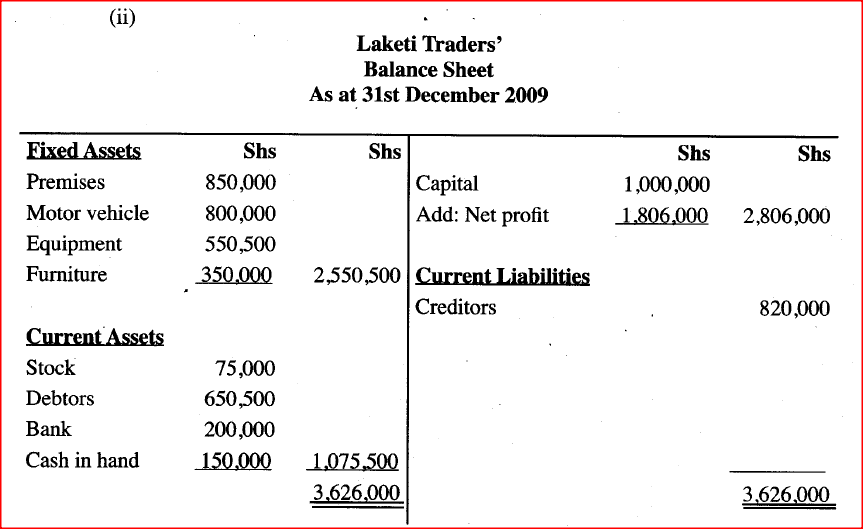

Using the information given above, prepare:

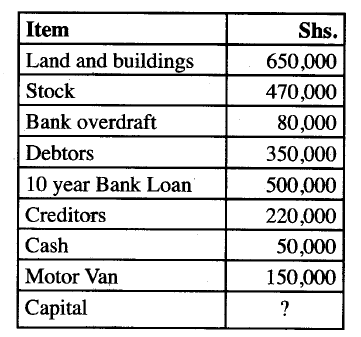

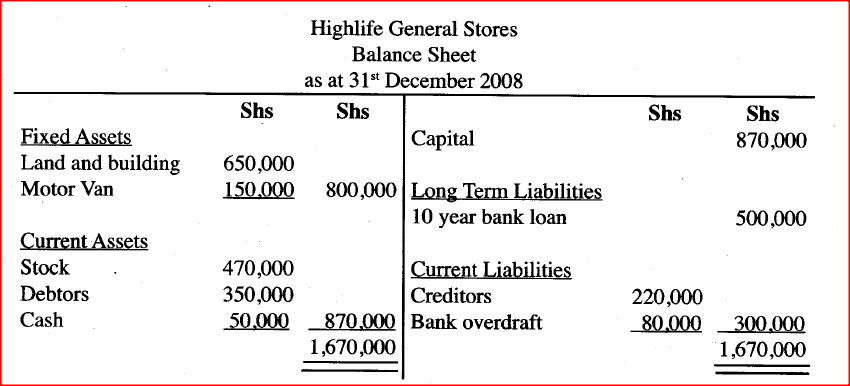

(i) A profit and loss account; (5 marks) (ii) A balance sheet. (7 marks) The following balances were extracted from the books of Highlife General Stores on 31st December 2008:

Prepare the balance sheet of Highlife General Stores as at 31 st December, 2008.

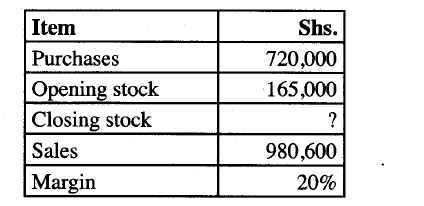

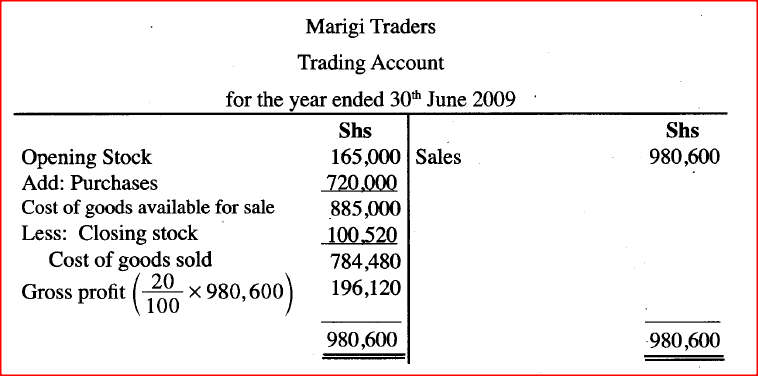

The following information was extracted from the books of Marigi Traders on 30th June 2009.19/12/2020 The following information was extracted from the books of Marigi Traders on 30th June 2009.

Prepare the Trading Account of Marigi Traders for the year ended 30th June 2009. (5 marks)

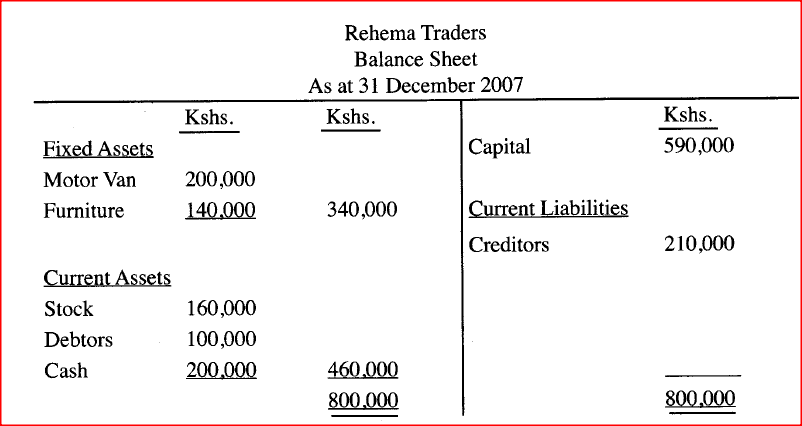

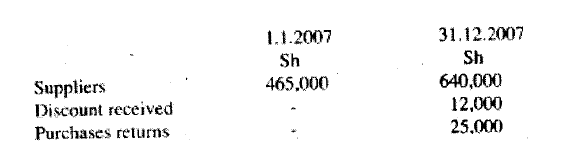

The following balances were extracted from the books of Rehema Traders on 1st January. 2007.17/12/2020 The following balances were extracted from the books of Rehema Traders on 1st January. 2007.

The following transactions took place during the year ended 31 st December, 2007:

(i) Sold furniture worth Ksh. 60,000 for which Ksh. 40,000 cash was received and the balance was due at the end of the year. (ii) Purchased goods worth Ksh.100,000 for which cash of Ksh. 70.000 was paid and the balance was still outstanding at the end of the year. (iii) Cash Ksh. 10,000 was taken from the business by the proprietor to settle the spouse’s hospital bill. Required: Draw Rehema Trader’s balance sheet as at 31st December, 2007 showing the items in their relevant classes. (10 marks)

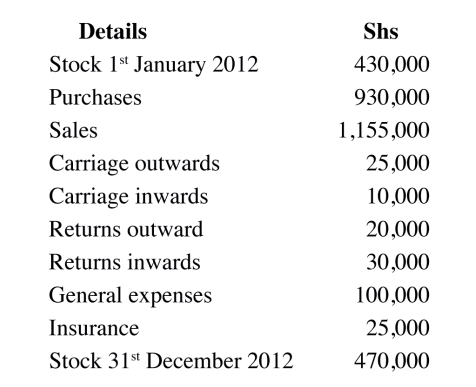

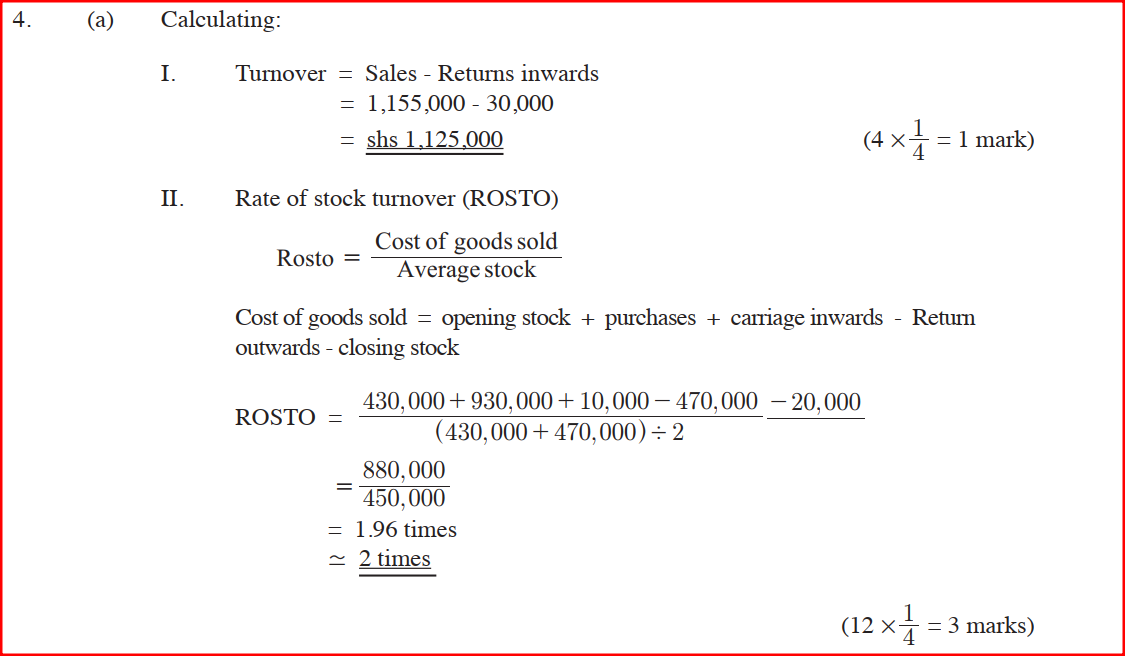

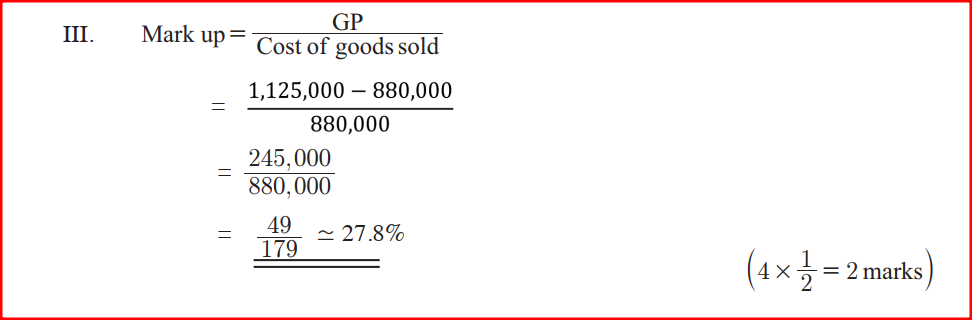

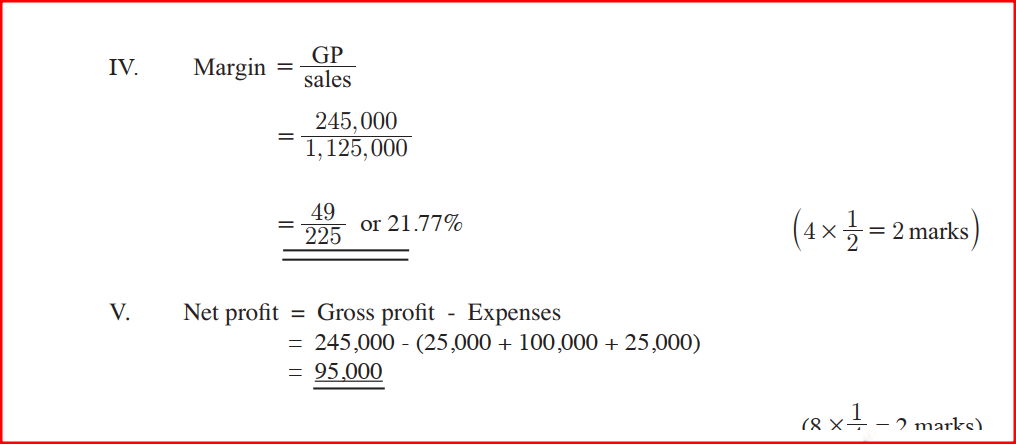

The following information relates to Bahati enterprises:

Calculate:

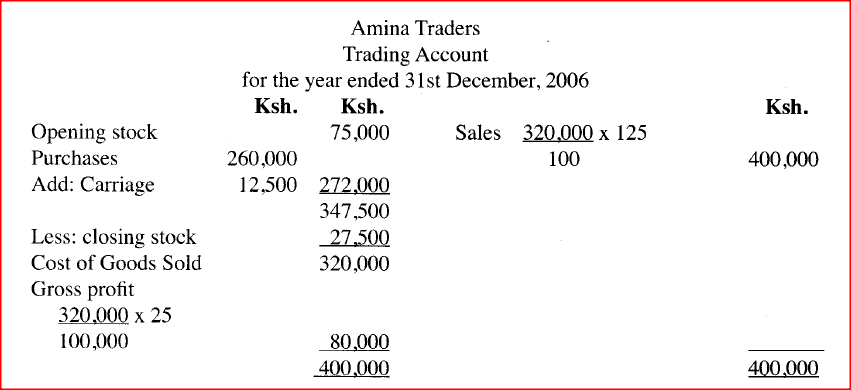

Expected ResponseThe information given below was extracted from the books of Amina Traders on 31st December 2006.17/12/2020 The information given below was extracted from the books of Amina Traders on 31st December 2006.

Ksh

The following balances were extracted from the books of Nafula Traders as at 31 December 2005.17/12/2020 The following balances were extracted from the books of Nafula Traders as at 31 December 2005.

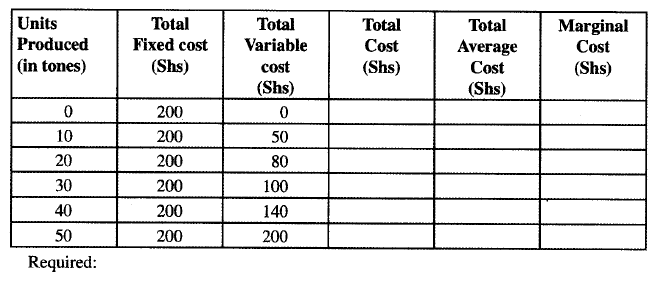

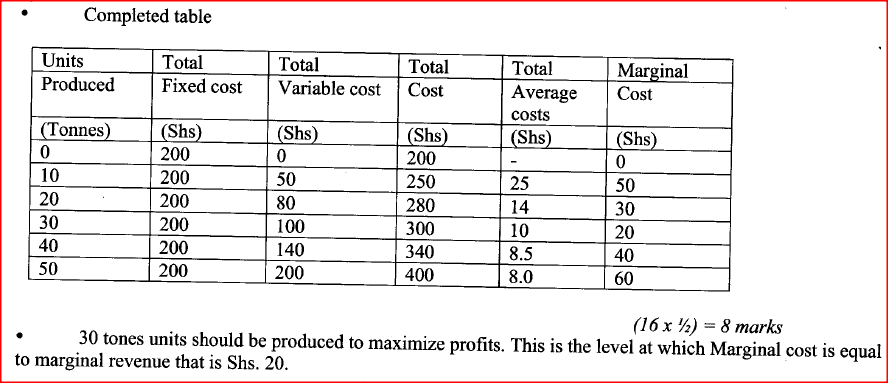

The information in the table below relates to product ZX whose unit price in the market is Shs 20.00.

(i) Determine total costs, total average costs, and marginal costs at each level of output. (8 marks)

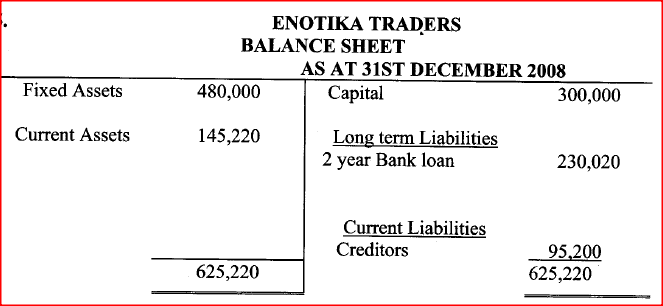

(ii) Determine the units to be produced in order to maximize profits.(2 marks) The balances given below relate to Enotika Traders for the year ended 31st December 2008.15/12/2020 The figure below shows a shift in the supply curve of a given commodity.

Shs

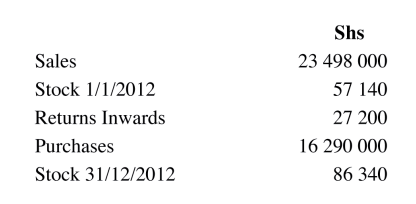

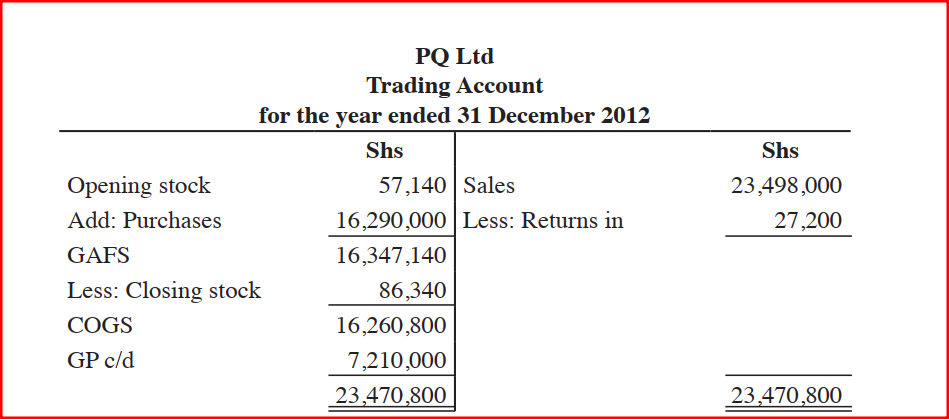

PQ Ltd had the following balances as at 31st December 2012.

Prepare PQ’s Trading Account for the year ended 31st December, 2012. (5 marks)

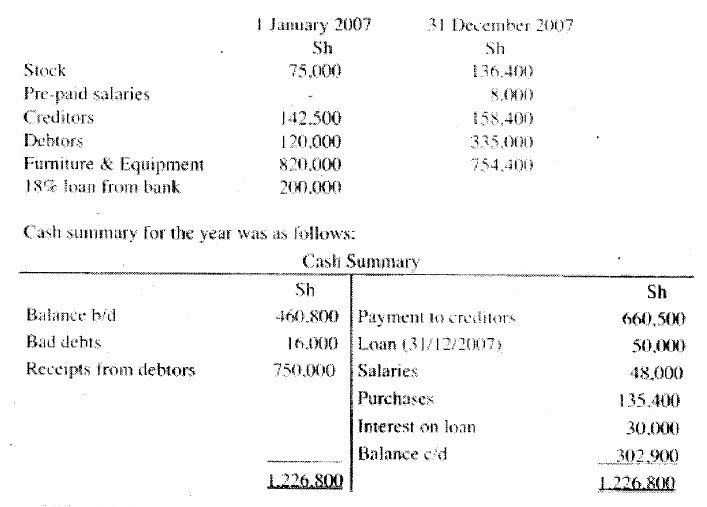

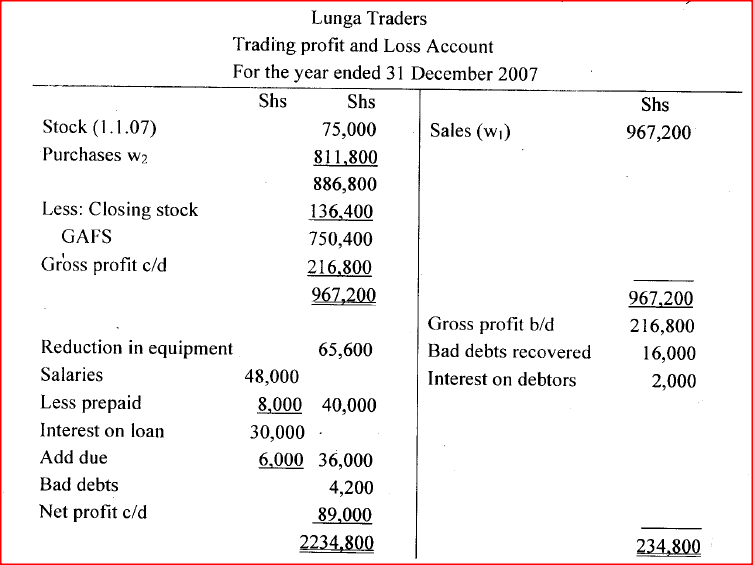

Expected ResponseLunga, a sole trader, does not keep a complete set of accounting records. Information extracted from the records are as follows

Additional information:

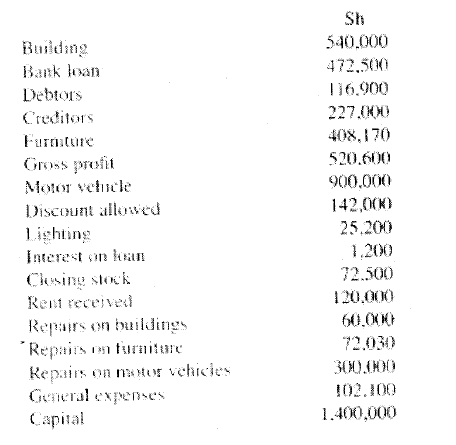

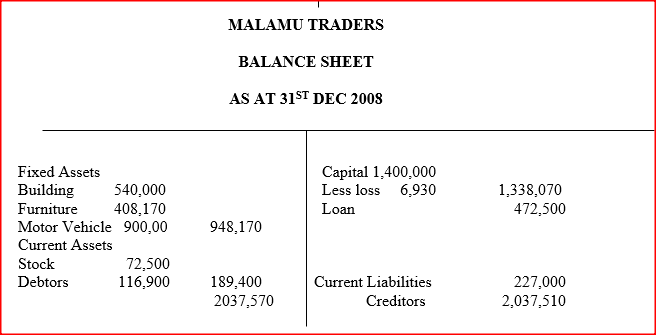

(i) Interest charged on debtors overdue accounts amounted to Kshs 2,000 (ii) Bad debts written off amounted to Kshs 4,200 Prepare trading, profit and loss account for the year ended 31 December 2007 (10 mks) Malamu Traders had the following balances s at 31 December 2008

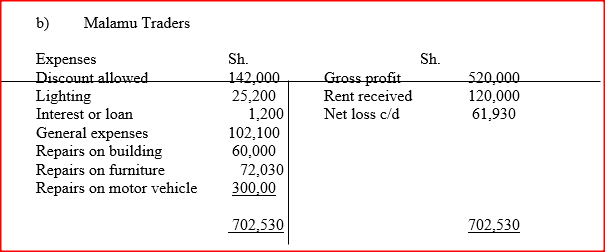

Prepare:

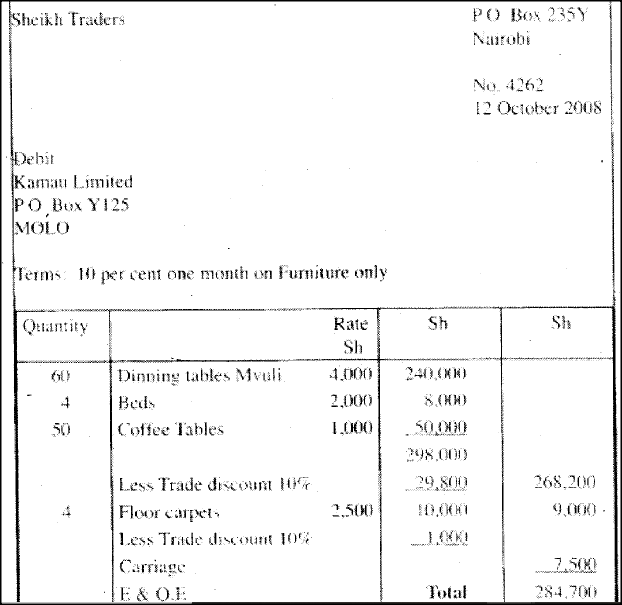

(a) Profit and loss account for the year ended 31 December 2008 (b) Balance sheets as at 31 December 2008 ( 12 mks) Analyze the following document issued by Sheikh Traders

Analyze the following document issued by Sheikh Traders

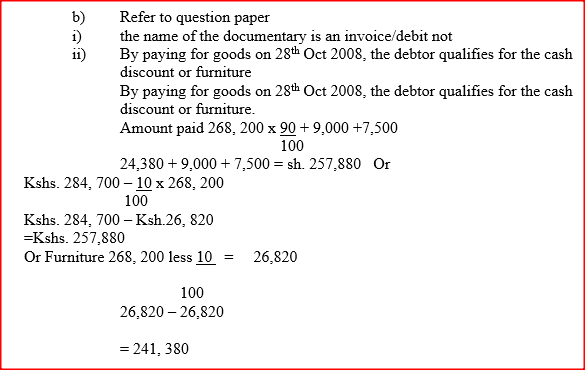

Required: (i) Name the document above (ii) Calculate the amount paid for the goods, if the debtor paid on 28th October 2008 (iii) Determine the net profit of the business if transaction (ii) above was Kshs 120.400 and the debtor paid for the goods on 15th November 2008 The following information relates to Maji Mazuri Traders as 31. 12. 2008

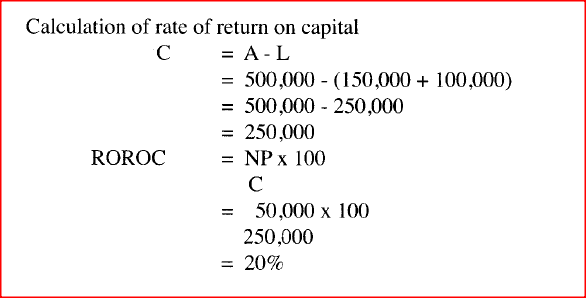

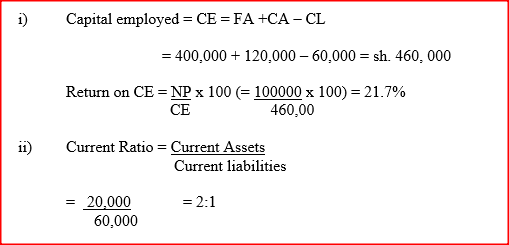

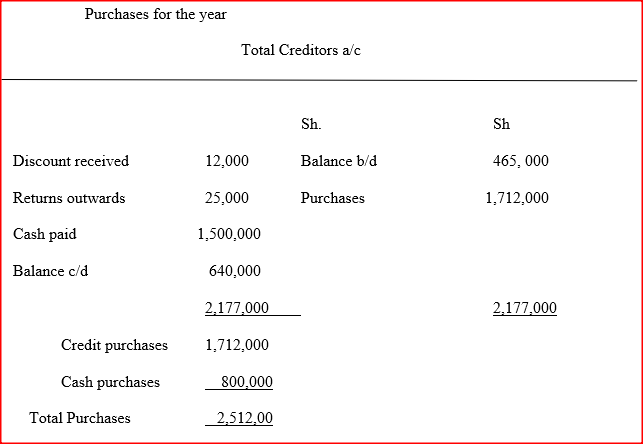

(i) Rate of return on capital employed (ii) Current ratio The bookkeeper of trade Traders extracted the following information from the accounting records.During the year ended 31.12.2007, suppliers were paid Kshs 1,500, 000 while cash purchases amounted to Kshs 800,000

During the year ended 31.12.2007, suppliers were paid Kshs 1,500, 000 while cash purchases amounted to Kshs 800,000

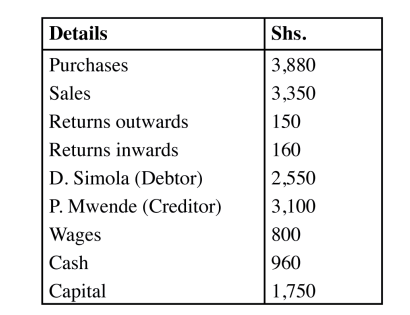

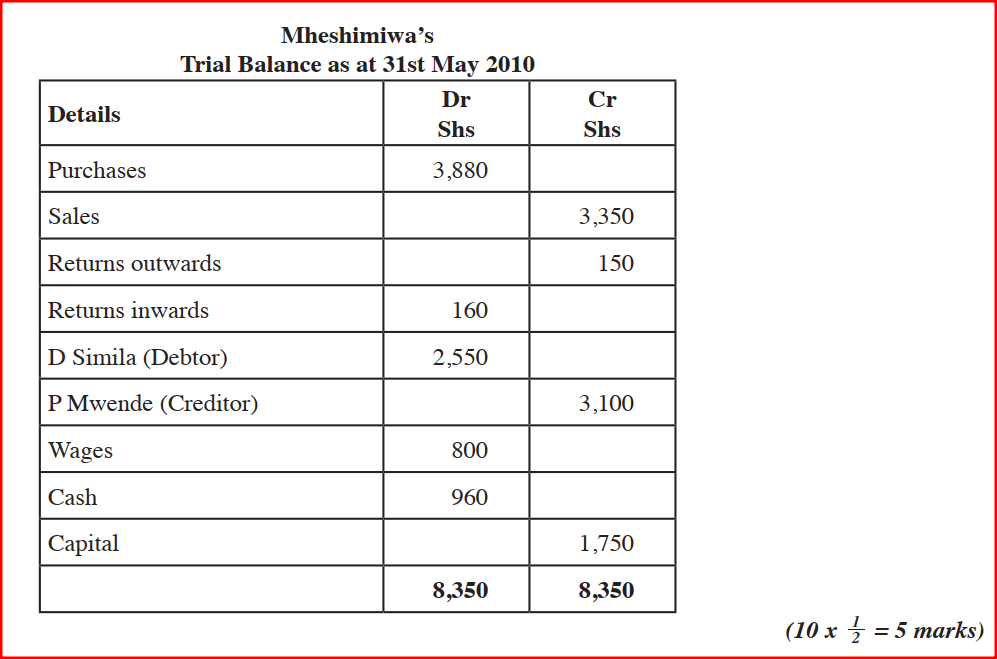

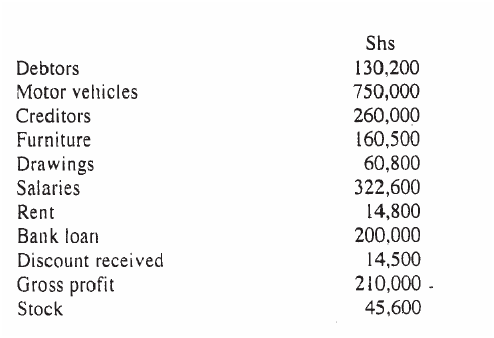

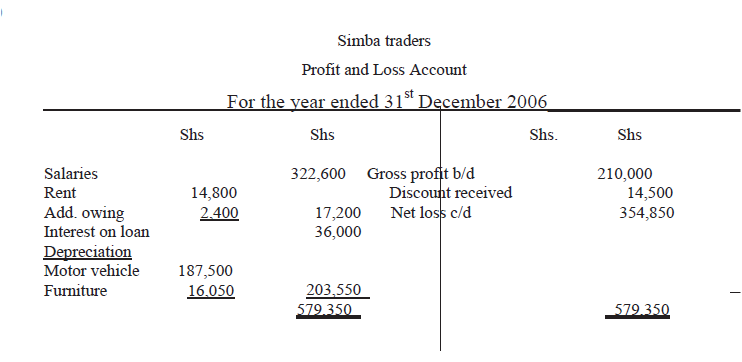

Determine the purchases for the year (5 mks) Mheshimiwa Ltd. had the following ledger account balances as at 31st May 2010: Required: Prepare Mheshimiwa’s trial balance as at 31st May 2010. (5 marks) Expected ResponseThe following balances were extracted from books of Simba Traders for the year ended 31 December 2006,

Additional information

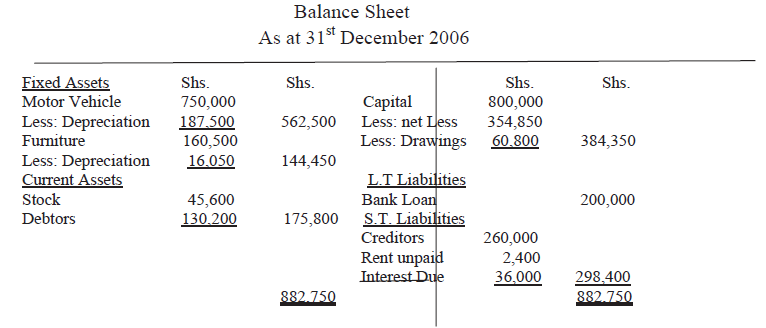

(i) Motor vehicle is depreciated by Sh187 500 while furniture is to be depreciated by Sh16 050 per year. (ii) Interest on loan is charged at 18% per year. This interest was still owing on 31 December 2006. (iii) Rent unpaid on 31 December 2O06 was Sh 2400 Prepare (a) Profit and loss account for the year ended 31 December 2006 (b) Balance sheet as at 31 December 2006.(12 marks) Memon Traders does not keep a complete set of accounting records. The following information relates to the year ended 31 December 2006.

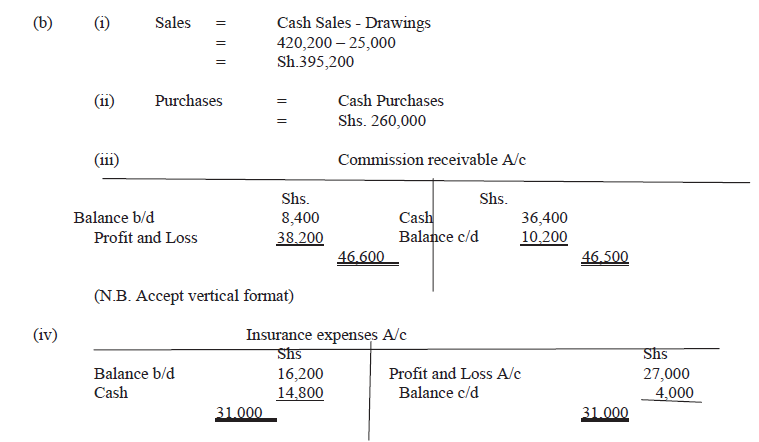

Additional information

Included in credit sales are drawings of stock ra1ued at Sh 25 000. For the year ended 31 December 2006, determine the following: (i) Total sales (ii) Total purchases (iii) Commission receivable (iv) Insurance expense (v) General expenses (10 marks) The following balances were extracted from the books of Solai Traders as at 31 May 2006

Sh.

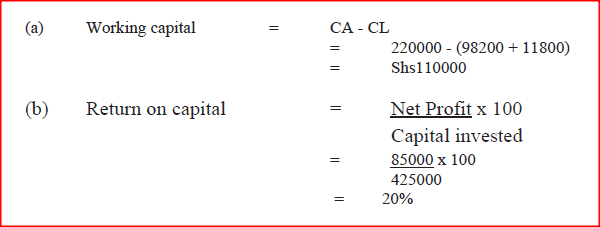

Current assets 220,000 Capital 425,000 Net profit 85,000 Creditors 98.200 Accrued expenses 11,800 Determine: (a) Working capital (2 marks) (b) Return on capital (2 marks) The following trial balance was prepared from the books of Mugambi Traders for the year ended 31 December 2005

Prepare

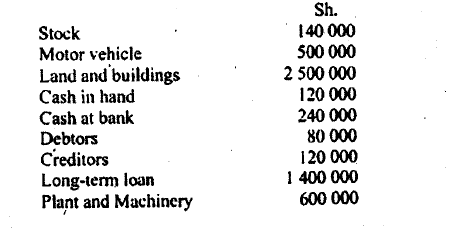

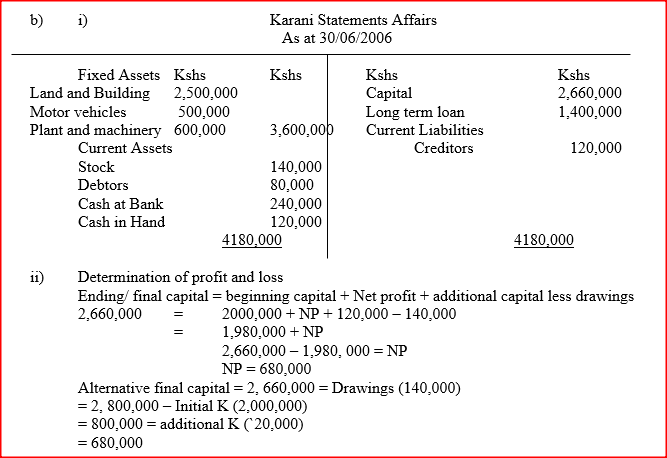

(i) A balance sheet for the year ended 31 December 2005 (ii) Determine Working capital Capital employed Borrowed capital Karani does not keep a complete set of accounting records.During the year ended 30 June 2006, the following balances were extracted from the books of accounts.

Additional information:

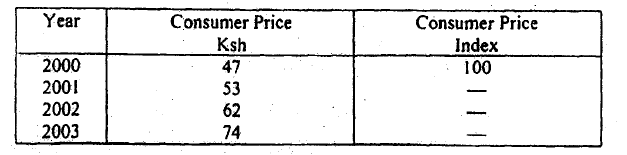

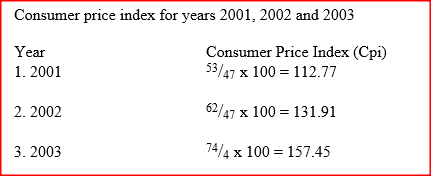

Karani drew sh. 140,000 from the business for private use. Opening capital was sh.2000 000 as at 1 July 2005 Additional capital during the year was sh.120,000. i) Prepare statement of affairs for the year ended 30 june 2006 ii) Determine profit or loss for the year ended 30 june 2006 The average consumer price for a 500g container of cooking fat for various years is shown in the table below.

Calculate the consumer price index using year 2000 as the base year

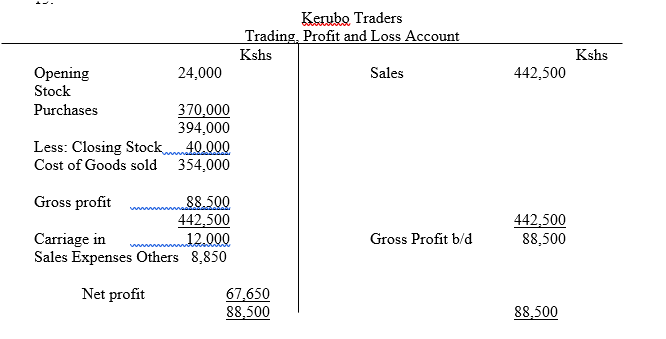

The following information related to Kerubo Traders for the year ended 31 December,2006. Prepare Trading profit and Loss Account for the year ended 31 December, 2006.

Prepare Trading profit and Loss Account for the year ended 31 December, 2006. (5mks)

|

Categories

All

Archives

December 2024

|

We Would Love to Have You Visit Soon! |

Hours24 HR Service

|

Telephone0728 450425

|

|

8-4-4 materialsLevels

Subjects

|

cbc materialsE.C.D.E

Lower Primary

Upper Primary

Lower Secondary

Upper Secondary

|

teacher support

Other Blogs

|

RSS Feed

RSS Feed