KCSE BASED BUSINESS STUDIES QUESTIONS WITH ANSWERS

State four principles of insurance

0 Comments

Explain the procedure for making an insurance claim

Reasons for taking endowment policy.

Procedures taken to obtain a valid insurance policy.

Name four types of marine insurance policies. (4mks)

Four types of marine insurance policies.

Benefits of endowment policy

Explain five characteristics of property insurance.

Characteristics of property insurance include:

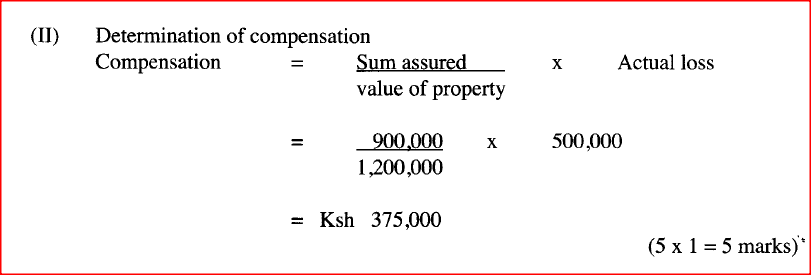

A farmer’s house valued at Ksh. 1,200,000 was insured against fire for Ksh. 900,000 under the “with average clause”. Fire occurred and damaged the house causing a loss of Ksh. 500,000. Determine the value of compensation due to the farmer..Explain the procedure for making an insurance claim.

State three features of an insurable interest.

Features of insurable interest include:

State four reasons why the government should create an enabling environment for investors.15/12/2020 State four reasons why the government should create an enabling environment for investors.

Reasons why the government should create an enabling environment to investors include:

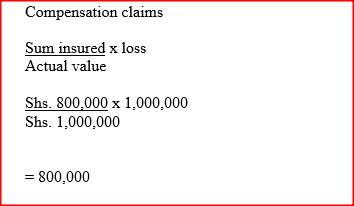

KAMAT owned a motor vehicle valued at Kshs 1,000,000. He comprehensively insured the car at Kshs 800,000. The motor vehicle was involved and declared a write off. Calculate the amount KAMAT should get from the insurer.

KAMAT owned a motor vehicle valued at Kshs 1,000,000. He comprehensively insured the car at Kshs 800,000. The motor vehicle was involved and declared a write off. Calculate the amount KAMAT should get from the insurer.

Explain the meaning of the following terms: (4 marks)

(a) Insured . (h) Insurance . Meaning of insured and Insurance

(a) Insured:

Is an individual or business unit that signs an insurance contract to be covered against a risk of loss and can therefore be compensated in the event of the loss occurring. (b) Insurance: Is an arrangement (contract) in which the insured pays premiums to the insurer so as to be compensated in case of loss occurring as a result of an insured risk. Elephant Enterprises acquired a building valued at sh 1 000 000 on 1 January 2007,The building was insured with two insurance companies. Zebra and Simba for sh 600 000 and.sh 400 000 respectively. In May 2007, fire damaged the building.causing Elephant Enterprises to suffer a loss of 20% of the building value. Determine contribution made by Simba and Zebra to cover the loss.Outline three features of a Re – insurance company

Outline three features of a Re – insurance company

Differences between life assurance and general insurance

Risks against which a shopkeeper may insure.

Four features of an insurable interest

State the principles of insurance described in the statements given below

Factors that would make two people taking the same type of life assurance policy with the same insurer to pay different amounts of premium

Factors that would make two people taking the same type of life assurance policy with the same insurer to pay different premiums include:

Related 'Insurance' ResourcesPrinciples of Insurance(i) Principle of indemnity

Insurance aims at restoring the insured to the financial position he/she was in before the loss occurred and not benefit him/her.

(ii) Insurable interest

The insured must prove that the occurrence of the risk will cause him/her financial loss.

(iii) Utmost good faith (uberrima fidei)

The insured must disclose all materials and relevant information that may affect insurance contract it subsequently comes to light.

(iv) Proximate cause.

There must be a fairly close connection between the cause of the loss and the risk insured.

(v) Subrogation.

In case of total loss and full compensation the insurer, assumes the rights that insured had on the property destroyed.

(vi) Contribution

In case of property being insured by more than one insurance firm, all the insurers share the burden of compensation in the proportion of coverage of the risk.

AnswerProcedure for obtaining an insurance policy

|

Categories

All

Archives

December 2024

|

We Would Love to Have You Visit Soon! |

Hours24 HR Service

|

Telephone0728 450425

|

|

8-4-4 materialsLevels

Subjects

|

cbc materialsE.C.D.E

Lower Primary

Upper Primary

Lower Secondary

Upper Secondary

|

teacher support

Other Blogs

|

RSS Feed

RSS Feed