LATEST BUSINESS STUDIES NOTES

Barriers to Effective CommunicationCommunication is said to be complete only when the recipient gets the message the way the sender intends it to be. When information is not received the way it was intended then it has been distorted. Distortion of a message is brought about by some communication barriers which may exists in the path of the message between the sender and the recipient. Some of these barriers are;

Service That Facilitate CommunicationServices that facilitate communication include;

Mailing services This refers to handling of letters and parcels. They are offered by organizations such as postal corporation of Kenya (P.C.K) Securicor courier and Document handling Limited (D.H.L) Some of the services offered by the postal corporation include;

a) Ordinary Mail These include surface mail and air mail.

An express mail is/must be presented at the post office counter by the sender and the envelope clearly addressed and a label with the word “express” affixed. Normal postage plus an extra fee (commission) is charged The mail is delivered to the receivers nearest post office from where the post office makes arrangements to deliver the mail to the receiver within the shortest time possible. NOTE: For speed post special arrangements to deliver the mail start at the sender’s post office whereas express mail, the arrangements start at the addressers post office. c) Poste Restante; This is a service offered by the post office to travelers who may wish to receive correspondence right away from their post office box. The addressee has to inform those who may wish to correspond with him/her of the nearest post office he is likely to use at a particular time Under this arrangement when addressing the letter, the words poste Restante must be written on the envelope clearly. The addressee must identify himself/herself when collecting the correspondence from the post office. There is no additional charge made apart from normal postage charges. This service can only be offered for three months in the same town. a) Registered Mail; This service is offered by the post office for sending articles of value for which security handling is required. A registration fee and a commission is paid. The commission depends on the weight of the article and the nature of registration. The sender is required to draw a horizontal and a vertical line across the faces of the envelope. A certificate of registration is given to the sender. In case of loss, the sender may be paid compensation on production of the certificate of registration. A green card is sent to the recipient. The card bears his name and the post office at which the mail was registered. The recipient will be required to identify himself before being allowed to possess the mail. Items that may be registered include jewels, certificate, land title deeds etc. b) Business Reply Service; This is a service offered by the post office to business firms on request. The firm pays some amount to the post office and an account is then opened from which posted charges are deducted. The service is useful/more common with firms which would like to encourage their customers to reply their letters. Customers are issued with reply card envelopes (or envelopes marked ‘postage paid’) They can send letters to the business by using these envelopes/the card. The customers then place the card/envelope in the post box and the firm’s post office branch will deduct postage charges from the lump sum amount. a) Courier Services These are services where a service provider receives transports and delivers parcels or important documents to destinations specified by customers in return for payment of fees or charges. Examples; Akamba bus service, Securicor courier services etc. ii) Telephone services

Telkom Kenya, through the post office, provides telephone services which offer direct contact between people who are far apart. It makes conversation between people at any distance possible, as long as there are transmission facilities between them. Urgent matters can be discussed and consultations can take place so that instant decision or actions are taken. The telephone assists organizations to establish a fast and convenient machinery for its internal and external communication network. ii) Cellular(mobile)phone services These are hand held telephones with digital links that use radio waves. They are sometimes called cell-phones since they use power stored in a dry cell In Kenya mobile phone services are provided by safaricom Ltd.(a subsidiary of Telkom Kenya)and Airtel communications Ltd(formally Kencel Communication Ltd)which is a joint venture between a French company and a Kenyan company, yu mobile services and Orange mobile services . This sector therefore greatly benefits from foreign investment to improve services. The use of this service is popular. Apart from the provision of telecommunication service, cell phones have different attractive features or services such as short messages service (sms) whereby a caller can send a written message. Recent models of mobile phones enable the user to access the internet and send e-mail messages Advantages of mobile phones

Disadvantages of cellular phones

iii) Broadcasting services Communication commission of Kenya is a regulatory body that receives applications and issues licenses for radio and television broadcasting stations. a) Radio stations Radio broadcasting is a very important mode of giving news and information to people in the whole world. The liberalization of the communications sector in Kenya in 1999, Kenya has witnessed a mushrooming of FM Stations which are owned by private sector operators e.g. Kiss Radio, Easy FM, Classic FM, Family FM, Kameme etc. They have helped to spread news and information countrywide. Before liberalization, Kenya Broadcasting cooperation (KBC) radio was operating as a state owned monopoly. b) Television Stations Television broadcasting (telecasting) does not reach as wide an audience as radio broadcasting in Kenya. It however serves the same purpose of relaying news and information to Kenyans. Both radio and television stations are widely used for advertising purposes. The T.V subsector has been liberalized since 1999 and a number of privately owned stations have emerged e.g. Kenya Television Network (KTN) Nation Television, Family T.V etc. Prior to that time KBC television was in operation as a state owned monopoly. Other services that facilitate communication

Current trends and Emerging issues in communicationWith the advancement of information technology (I.T) there has been a lot of revolution in communication. The following are some of the current trends and emerging issues in communication; Telephone Bureaux (Bureaus)These are privately owned kiosks where telephone services are sold. The owner of the kiosk must get authority from the service provider in order to run the bureau. The individual wishing to use the services of the bureau makes payments to the owner of the service. Other services offered by the bureau include selling of scratch cards for mobile telephones and credit cards for landline telephone services. i) Mobile phones (cell phones) These are hand held telephones with digital links that use radio waves. They have become an important business and social tool. This is because most people and traders want some flexibility to be able to communicate whenever they are. Other reasons that have led to the popularity of cell phones include:

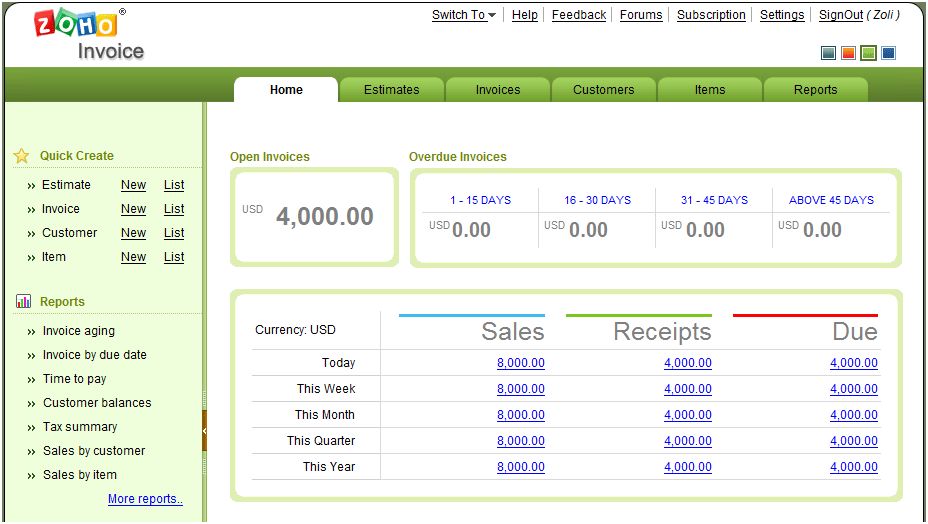

This is a service provided through the internet for sending messages. It is similar to sending a letter through the postal system only that it is done electronically. Messages can be sent to anyone on the network, anywhere in the world. For this to take place, computers have to be connected to each other to form a network. To communicate, one is required to have an email address e.g. raeform2@ yahoo.com. Messages arrive at the e – mail address immediately they are sent. It is only the addressee of the message who can retrieve the message since a password is required to access the mailbox. E – Mail can also be used to send documents and photographs like certificates by scanning and attaching. More and more businesses are using e- Mail to communicate with other businesses, their customers and suppliers. iv) Internet The internet links computers all over the world. Written and oral information is transmitted on the internet through the use of telephone wires, fibre- optic cables and wireless devices. The internet has changed the way people communicate in the following ways;

The future office will rely largely on computers. Most of the communication will be done through computers. This may result in less use of paper, hence the use of the term “the paperless office”. Vi) Decline in the use of postal services Decline in the use of postal services is a result of the impact of the internet. E-mail has become a popular and preferred mode of communication since it is fast and cheap. However, ordinary mail/ use of postal services may not be completely phased out since the government, businesses and people do not regard an e-mail as a binding or formal communication. Vii) Transformation of language The language used to pass and receive messages has evolved through time. e.g. the youth have adopted the use of “sheng” in exchanging messages. Such language is largely understood by its youthful users. There is also the use of cell phones to send short text messages; which are highly abbreviated and may use slang whose meaning is only known to the users. Communication Revision Questions1. Define the term communication Communication is the process by which information is passed from one person or place to another. 2. Outline the role played by communication in any given organization

(a) Vertical communication Involves the flow of information either downwards or upwards, for example, from a senior employee to a junior employee (b) Horizontal communication Is also referred to as lateral communication which is passing of information between people of the same rank or status, for example from one departmental manager to another departmental manager (c) Diagonal communication This is communication of different people in different levels of management or departments for example a receptionist communicating to a production manager. 4. Distinguish between formal and informal communication Formal communication is official and documented and follows certain rules for example a worker writing an official letter to an organization’s seniors. Informal communication does not conform to any time, for example communicating to friends and relatives. 5. State the essential elements in communication.

Advantages

Advantages

7 Comments

<

>

COMMUNICATION TOPIC OBJECTIVES.By the end of the topic, the learner should be able to:

SUB-TOPIC GUIDELINES

Meaning of communication

Effective communication is vital/important for business in that it serves the following purposes. Importance of communication (purposes)

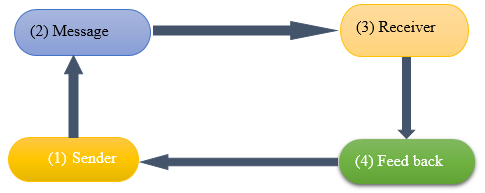

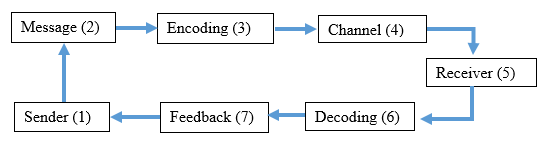

Communication processCommunication is a process that involves interchange of information and ideas between two or more people. Communication therefore is a circular process i.e. communication may lead to some reaction which in turn may generate further communications or feedback. This flow can be illustrated as below;

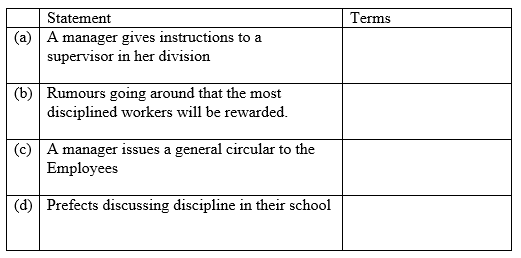

Lines of communicationCommunication can be classified according to either the levels of the communicating parties or according to the nature of the message.

A. According to levels This can either be:

Vertical communicationThis is where messages are passed between a senior and her/his juniors in the same organizations

Vertical communication can be divided into two parts:-

Downward communicationThis is a communication process which starts from the top manager to her/his juniors. This can be informed of:

Upward communicationThis is a communication process that starts from the juniors to the seniors and maybe in the form of:

Horizontal communication (lateral communication)This is communication between people of the same level (rank) in the same organization e.g. departmental heads in an organization may communicate to achieve the following:

Diagonal communicationThis is communication between people of different levels in different departments or different organizations e.g. an accounts clerk may communicate with a sales manager of the same organization or of different organizations. Diagonal communication enhances team work.

b) According to nature of message This can either be;

Formal communicationThis is the passing of messages or information using the approved and recognized way in an organization such as official meetings, memos and letters. This means that messages are passed to the right people following the right channels and in the right form.

Formal communication is also known as official communication as it is the passing of information meant for office purposes. Formal systems of communication are consciously and deliberately established. Informal communicationThis is communication without following either the right channels or in the right form i.e. takes place when information is passed unofficially. It is usually used when passing information between friends and relatives hence it lacks the formality.

Informal communication may also take the form of gossips and rumor-mongering. Informal communication usually supplements formal communication as is based on social relations within the organization. Note: Both formal and informal communication is necessary for effective communication in an organization. Essentials of Effective communicationFor communication to be effective it must be originated produced transmitted received understood and acted upon. The following are the main essentials to effective communications.

Forms and Means of CommunicationForms; these are channels or ways of passing on messages. The four main forms are;

Oral communicationThis is where information is conveyed by talking (word of mouth)

It is also known as verbal communication Means of communicationi) Face-to-face conversation

This involves two or more people talking to each other. The parties are usually near each other as much as possible to ensure effective communication. It is suitable where subject matter of discussion require convincing persuasion and immediate feed-back. It may be used during meetings, interviews, seminars, private discussions, classrooms e.t.c It is the most common means of oral communication Advantages of face-to-face communication

Disadvantages of face-to-face communication

ii) Telephone

This form of communication is commonly used in offices and homes. It is useful in sending messages quickly over short and long distances. It is however not suitable for sending;

Installation is done on application by the subscriber (applicant).He/she pays the installation fee in addition; the subscriber is sent a monthly bill with the charges for all the calls made during the month. The charges for calls depend on the time spent time of the day of the week and distance of the recipient from the caller e.g. it is cheaper to call at night than during the day. It is also cheap to make calls during public holidays and weekends than on weekdays. There are also mobile phones which have no physical line connection to exchange and may be fixed to a vehicle or carried in pockets. In Kenya these services are provided by safaricom, Airtel, orange and Yu mobile communications. Advantages of Telephones

Disadvantages of Telephone

Reasons why mobile phones have become popular

iii) Radio calls

This involves transmitting information by use of radio waves i.e. without connecting wires between the sender and the receiver The device used is called a radio telephone. It is commonly used in remote areas where normal telephone services are lacking or where telephone services are available but cannot be conveniently used e.g. policemen on patrol in different parts of a town Radio transmission is a one way communication system i.e. only one person can speak at a time. It is therefore necessary for the speaker to say ‘over’ to signal the recipient that the communication is through so that the recipient can start talking. To end the conversation, the speaker says ‘over and out’ The radio calls are commonly used by the police, game rangers, researchers, foresters, ship owners and hotels situated in remote areas. They are also used for sending urgent messages such as calling for an ambulance and fire brigade Note; Radio calls are not confidential since they use sound frequencies that can be tapped by any radio equipment that is tuned to that frequency Advantages of Radio calls

Disadvantages of Radio calls

iv) Paging

This is a means of communication used to locate staff or employers who are scattered in an organization or who are outside and need to be located urgently When within the organization portable receivers, lighted signals, bells, loudspeakers etc. are used When outside the organization employees are contacted using portable receivers (pocket-size) used to send messages through sms (short message services) The paying system can only be used within a certain radius. When using a portable receiver, the caller will contact the subscriber by calling the post office which will then activate the pager. The subscriber is then informed to contact the originator of the message. Paging is mostly used in emerging cases v) Radio

Usually messages intended for a wide audience can be transmitted through a radio more quickly and economically than by using other forms of communication. Radio is used for different reasons apart from advertising e.g. for formal notices, and venue for activities Advantages of oral/verbal communication

Disadvantages of oral/verbal communication

vi) Written Communication

This involves transmission of messages through writing. It is the most formal way of communication because the information is in recorded form and can be used for reference Means of written communication (i)Letters

Letters are the most commonly used means of communication. There are two categories of letters;

Business letters are written to pass messages and information from businessmen to customers and vice versa e.g. letters of inquiry and acknowledgement notes. It can also be used between employees and employers in an organization e.g. a complimentary note. Official letters are letters between people in authority and others that touch on the activities of the organization e.g. an application letter for an advertised vacancy in an organization. Formal letters have a salutation clause which usually starts with “Dear Madam “or “Dear Sir”. It also bears the addresses of both the sender and the recipient, a subject heading and a complimentary clause ending with “Yours faithfully”. b) Informal Letters; these are letters between friends and relatives They are also known as Personal letters ii) Telegrams

This is a means of communication provided by the post office. The sender obtains the telegram form from the post office and fills the message on it in capital letters and hand it over to the post office employees at the counter. Alternatively the sender may use a telephone to read the message to the post office. The post office then transmits the message to the recipient post office. The charges of a telegram are based on the number of words used, the more the words used the higher the charges. However there is a standing charge. Telegrams are used for sending urgent messages. Note; Due to changing technology telegrams have lost popularity. Short messages can now be sent by cell phones (mobile phones) using the short messages services (sms) iii) Telex

This is a means of communication used to send short or detailed messages quickly by use of a teleprinter. The service is provided by the post office on application. A message is sent by use of two teleprinters one on the senders end and another on the recipients end. When sending information through a teleprinter which is a form of electric typewriter producing different electric signals, its keys are pressed and automatically the message is printed at the recipient’s machine. Telex saves time for both the sender and recipient as the messages are brief precise and received immediately. However it’s an expensive means of communication iv) Facsimile (Fax)

This involves transmission of information through a fax machine. Both the sender and the receiver must have a fax machine. These machines are connected using telephone lines Fax is used to transmit printed messages such as letters, maps, diagrams and photographs. To send the information, one dials a fax number of the required destination and then the document is fed into the sender’s machine. The receiving machine reproduces the document immediately. It is used for long distance photocopying service. v) Memorandum (Memo) This is printed information for internal messages within an organisation. It is normally used to pass information between departments or offices in an organization. Memoranda have no salutation or complimentary clause. They are suitable for informing the officers within an organization of matters related to the firm. A memo is pinned on the notice board of an organization if it is meant for everybody otherwise passed to the relevant staff. vi) Notice This is a written communication used to inform a group or the public about past current or future events. It is usually brief and to the point. It can be placed on walls, in public places, on trees, in newspapers or on notice boards. viii) Reports

These are statements/within records of findings recommendations and conclusion of an investigation/research. A report is usually sent to someone who has asked for it for a specific purpose. viii) Circulars These are many copies of a single letter addressed to very many people when the message intended for each is the same. ix) Agenda This is an outline of the items to be discussed in a meeting. It is usually contained in a notice to a meeting sent in advance to all the participants of the meeting. The notice of the meeting contains;

These are records of the proceedings of a meeting. Keeping minutes of certain meetings is a legal requirements e.g. companies Keeping minutes for other meetings are for management purposes to ensure that decisions made at the meetings are implemented Advantages of written communication

Disadvantages of written communication

3) Visual Communication

This is the process of passing information by use of diagrams, drawings pictures, signs, and gestures etc. a)Photographs A photograph is an image (visual representation of an object as it appeared at the time when the photograph was taken Photographs are self-explanatory and may not be accompanied by any narration or explanation. The recipient is able to get the message at a glance. b) Signs Refer to marks, symbols, drawings or gestures whose purpose is to inform the public about such things as directions, distances, dangers and ideas. Examples; road signs, traffic lights and danger signs on electricity poles This means of communication can only be effective if the meaning of the sign used is understood. Graphs; these are used to show and illustrate statistical information Charts; these are diagrams which show or illustrate the flow of an idea e.g. an organization chart illustrates the whole organization structure indicating the chain of command Advantages of visual communication

Disadvantages of visual communication

4) Audio-Visual communication

This is a form of communication in which messages are sent through sounds and signs. This form of communication ensures that the receiver gets the message instantly. It is suitable where both the sender and the receiver know the meaning of specific sounds and signs. Means of Audio-visual communication

Advantages of Audio-visual communication

Disadvantages of Audio-visual communication

5) Audio Communication

This is when the message is transmitted through sounds. Examples include

Advantages of Audio communication

Disadvantages of Audio communication

communication questions and answers1. 1996 P1

Outline four reasons why a business person may prefer written communication to verbal communication. (5 marks) 2. 1997 P1 State five services offered by the post office. (5 marks) 3. 1998 P1 State four advantages of verbal communication. (4 marks) 4. 1999 P1 Highlight four advantages of using telex as a means of communication. (4 marks) 5. 1999 P2 Discuss the factors that a firm may consider in choosing a method of communication within the firm 6. 2000 P1 State four features of effective communication. (4 marks) 7. 2001 P1 State four reasons why the post office is still popular as a means of sending letters. (4 marks) 8. 2001 P2 State reasons for use of letters in business communication. 9. 2002 P1 Give four reasons why a person would send a message by mail rather than by telephone. (4 marks) 10. 2003 P1 Highlight four factors that may limit the use of telephone as a means of communication in Kenya. (4 marks) 11. 2004 P1 State four problems that may interfere with the effectiveness of face to face communication. (4 marks) 12. 2006 Q15 P1 Give four reasons why one would prefer a letter to a telephone to send a message. (4 marks) 13. 2007 Q2 P1 The following terms relate to communication: vertical, horizontal, formal and informal. Write the appropriate term of communication associated with each of the following statements. 14. 2007 Q1b P2

b) Explain four advantages of transaction business through e-commerce. (8 marks) 15. 2008 Q5 P1 Outline four benefits that may accrue to a business person who uses e-mail to communicate. (4 marks) 16. 2009 Q12 P1 Outline four circumstances under which face to face communication may be ineffective. 17. 2012 Q5 P1 Outline one circumstance under which each of the following telecommunication services may be used:

(b) Explain five elements of effective communication. (10 marks)

<

>

TOPIC OBJECTIVESBy the end of the topic, the learner should be able to:

GUIDELINES ON TOPICS

MEANING OF TRANSPORTTransport is the physical movement of people and goods from one place to another. It helps bridge the gap between producers and consumers hence creating place utility.

Importance of Transport to Business

ESSENTIAL ELEMENTS OF TRANSPORTIn order for a transport system to function efficiently it should have certain basic elements, these elements are:

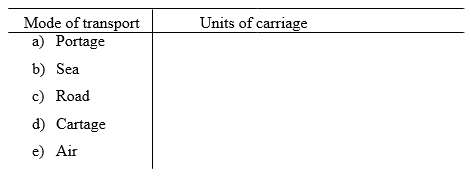

A. Unit(S) of carriageThis refers to anything i.e. vessel that is used to transport goods and people from one place to another. Units of carriage include: ships, trains, airplanes, motor vehicles, bicycles and carts. Units of carriage are also referred to as means of transport.

b. Methods of propulsionThis is the driving force (source of power) that makes a unit of carriage to move. The power for most vessels may be petroleum products, electricity, human force or animal power.

c. WaysIt refers to either the route or path passes by the vessel. The route can be on land, on water or through air. Examples of ways are roads, railways, paths, canals, seaways and airways. The ways can be classified into either natural ways or man made ways.

d. Terminals (terminuses)The vessel used to carry goods and people starts from one destination and ends up at another. At these destinations the loading and off-loading take place respectively. The loading and off-loading places are referred to as terminals or terminus. Examples of terminuses are bus stations, airports and seaports.

MODES OF TRANSPORTMode refers to the manner in which transport is carried out. There are three modes of transport namely:

Land transportThis mode of transport involves movement of goods and people using units of carriage that move on dry land. The various means under this mode includes:

Human PorterageThis involves human beings carrying goods on their heads, shoulders or backs. Human Porterage as a means of transport is the oldest kind of transport and is still very common in our society. The means is suitable for transporting light luggage over short distances. It is also appropriate where other means of transport are not available or convenient.

Advantages of Human Porterage

Disadvantages of human Porterage

CartsCarts are open vessels usually on two or four wheels that are pushed or pulled by either human being or animals such as oxen and donkeys. The carts pushed or pulled by human beings are referred to as hand carts or mikokoteni. The ones pulled by animals, on the other hand, are called animal driven carts. Carts are used to carry relatively large quantities compared to human Porterage. Like human Porterage, they are not suitable for long distances. Types of goods that are transported using this means include, agricultural produce, water and animal feeds.

Advantages of carts

Disadvantages of carts

VehiclesThese are means (units of carriage) of transport that ferry goods and people on roads. Vehicles are the most commonly used means of transport.

Vehicles are either passenger or goods carriers. Passenger carriers may be buses, matatus, taxis and private cars while goods are transported using Lorries, pick-ups, tankers and trailers. Vehicles are expensive to acquire and maintain. The convenience of vehicles may depend on the nature of the road on which they travel. Some roads are impassible especially when it rains while others are usable throughout the year (all weather roads).Of special concern in road transport is the matatus. These are privately owned passenger vehicles which were introduced to supplement the existing mainstream transport companies that were inadequate at independence. They got their name from the amount of fare they used to charge originally that is, mapeni matatu. The operators have to obtain the relevant documents such as insurance cover in order to be allowed to operate. Their owners may form associations which take care of their interests along given routes or in certain areas. Advantages of matatus

Disadvantages of matatus

Advantages of vehicles

Disadvantages of vehicles

TrainsTrains are vessels that transport goods and people on rails hence the term railways.

The terminuses of trains are the railways stations. Therefore; the goods to be transported by trains have to be taken to the railway station. Railway transport is suitable for heavy and bulky goods as well as passengers. There are two types of trains: cargo and passenger train. Advantages of Trains

Disadvantages of Trains

Pipeline TransportThis is the movement of liquids and gases from one place to another through a pipe. Products transported through pipes include water, gases, petrol and diesel. Solids that cannot be dissolved or damaged by water may also be transported through pipes as suspension. Examples coffee berries from machines to drying places. The pipeline is both a vessel and a way.

Products flow by the force of gravity or pressure from an original station. If the original terminal is at a higher level than the receiving terminal, the force of gravity is adequate to move the product. But if the receiving terminal is at a higher level than the original than the originating terminal, then power is required to pump the product uphill. For example, petroleum from Mombasa which is at sea level needs pressure to pump it to all the receiving stations. Advantages of pipeline Transport

Disadvantages of pipeline Transport

Water TransportIt is a mode of transport where the units of carriage transport goods and people on water. Water in this case includes; navigable rivers, lakes, seas and oceans. The means of transport which are the units of carriage or vessels using this mode include; ships, dhows, boats, steamers and ferries. Water transport can be divided into inland waterways and sea transport.

Inland waterwaysThis is transport carried out on lakes, rivers and inland canals. The Lake Victoria facilitates transport among the three east African countries i.e. Kenya, Uganda and Tanzania. Ferries also connect the mainland to islands such as Rusinga Islands, found in Lake Victoria.

Water hyacinth has however been a threat to transport on the lake. Most rivers in Kenya are not navigable due to reasons such as:

Sea TransportThis is where goods and people are transported in seas and oceans. All types of water vessels may be used in sea transport. Sea transport is important as it connects continents of the world thereby facilitating international trade. Kilindini in Mombasa provides a good natural harbor facilitating sea transport between Kenya and other countries of the world. Ferries also connect the island of Mombasa and the mainland.

Types of Water vesselsShips

A ship is a large vessel that transports people or goods through water. Their sizes however vary depending on quantity of goods and passengers they carry. Ships help in connecting countries or places which borders the sea. They load and offload in terminals referred to as harbors found at sea ports. For example, the Kilindini harbor is found in the port of Mombasa. Ships that transport people are referred to as passenger ship while those that transport goods are referred to as cargo ships. Cargo ships are c are convenient for carrying heavy and bulky goods. Ships may also be classified as either liners or tramps. Liners

These are ships that are owned and operated by shipping companies called conferences. Each conference is responsible for specifying the route on which each liner would operate the rates to be charged and setting the rules and regulations to be followed by the members. Characteristics of liners

Tramps

These are ships that do not follow a regular route or time table. Their routes therefore depend on demand. During times when demand is high, they charge higher rates and when demand is low they lower their rates. Tramps can therefore be likened to matatus. Tramps may be owned by either individuals or firms. Characteristics of tramps

When a trader hires an entire ship to transport goods to a given destination, he/she and the ship owner signs a document called a charter party. This document shows the terms and conditions under which the goods would be transported. Other information included in the agreement are destination, nature of the goods and freight charges. When the ship is hired to carry goods for a given journey the document signed is referred to as voyage charter. On the other hand, if the ship is hired to transport goods for a given period of time, the document signed is called time charter. Ships may be specially built to carry special commodities. These may include tankers specially built to transport petroleum products and other liquids. Refrigerated ships may also be available to transport perishable commodities such as meat, fish and fruits. Boats and FerriesThese are water vessels used in transporting goods and people over short distances. They are therefore found in both inland water transport and also the sea transport, e.g. the Likoni ferry in Mombasa carries people from and to the island of Mombasa and the main land.

Advantages of water transport

Disadvantages of water transport

Air TransportThis refers to the movement of goods, people and documents by aircrafts. Aircrafts/ aeroplanes are the units of carriage and air the way. The terminals include airports and airstrips.

Aeroplanes are fast compared to other means of transport i.e. they are the fastest means of transport. They are therefore suitable for transporting urgently required goods like drugs and perishable goods Such as flowers over long distances. Aircrafts may be classified as either passenger planes or cargo planes. Passenger planes transport people from one place to another. On the other hand, cargo planes transport light cargo to the required destinations. Aeroplanes may be fitted with special facilities for handling special goods. Aeroplanes are expensive to acquire and to maintain. Their operations may also be affected by weather conditions. Advantages of Air Transport

Disadvantages of Air Transport

ContainerizationThis is a recent development in transport. It refers to the packaging of goods in standardized ‘box like’ containers designed for use in transporting cargo. The containers are mainly made of metal though a few are made of wood. They can either be hired or bought from firms that provide them. The hired containers are returnable to the owner after the goods have been transported.

Containers are designed in a way appropriate to transport goods by ships, train, lorry or by air. To safeguard the goods against risks such as theft and unfavorable weather conditions the containers are sealed immediately after goods have been packed. The sealed containers are then transported up to the final destination where they are off-loaded. The consignee can then break the seal. Goods can be transported in containers as Full Container Load (F.C.L) or as Less Container Load (L.C.L).Full container load applies where the container is filled with goods belonging to one person. In FCL, goods are delivered to the consignee intact. On the other hand, less than container load applies where a container is filled with goods belonging to several consignors. This may be the case where a single consigner does not have enough goods to fill a container. When such a container reaches the destination, it is opened and the various consignees take their goods. There are special handling facilities for loading and offloading containers onto and from the units of carriage. Apart from the container depot at Mombasa, Kenya Ports Authority (K.P.A) has established inland container depots referred dry ports. An example of a dry port is found at Embakasi in Nairobi. The establishment of dry ports aims at relieving congestion at the sea port. It also aims at making handling of cargo easier and efficient for inland importers and exporters. When containers are off loaded from ships at Mombasa, they are loaded into special container trains called railtainer which transports them by railway to the inland container depot at Embakasi. Containers can also be transported by specially designed trucks between the ports or from the port to consumer’s destination. Advantages of containerization

Disadvantages of containerization

Factors that influence the choice of appropriate means of transport

TRENDS IN TRANSPORT

TRANSPORT kcse questions

1. 1995 P1

Give three disadvantages of railway transport in Kenya. (4 marks) 2. 1995 P1 Give three disadvantages of railway transport in Kenya (3 marks) 3. 1995 P2 Explain five reasons that may account for continued use of handcarts as a mode of transport in Kenya. (12 marks) 4. 1996 P1 State four circumstances under which a businessman would choose to transport goods by air? (4 marks) 5. 1996 P2 The oil pipeline has recently been extended from Nairobi to western Kenya. Explain five benefits that may be accounted to the country from the extension. (10 marks) 6. 1997 P1 Outline four reasons why a school in Kisumu may prefer to transport its sixty students to a music festival in Nairobi by train rather than by bus. (4 marks) 7. 1998 P1 List four disadvantages of using containers to transport goods. (4 marks) 8. 1998 P2 Discuss five factors that have hindered the expansion of railway transport in Kenya. 9. 1999 P1 Give five reasons why a manufacturing firm would be located in an area well served by good road network. (4 marks) 10. 1999 P1 Outline four limitations of containerization. (4 marks) 11. 1999 P2 Explain five features of an efficient transport system (8 marks) 12. 2000 P1 State four reasons why road transport is popular in Kenya. (4 marks) 13. 2000 P2 Explain the advantages of pipeline as a mode of transporting oil products. (12 marks) 14. 2001 P1 State four ways in which the nature of goods would influence the choice of transport. (4 marks) 15. 2002 P1 Outline four reasons why a transporter of goods from Mombasa to Nairobi may prefer rail transport to road transport. (4 marks) 16. 2002 P2 Outline five factors that should be considered when choosing a means of transport. (10 marks) 17. 2003 P1

State the unit of carriage for each of the following modes of transport. (5marks) 18. 2003 P2

Explain six advantages of containerization as a mode of transport. (10 marks) 19. 2004 P1 List four ways in which transport promotes growth of trade. (4 marks) 20. 2004 P2 Discuss six factors that may discourage the use of pipeline as a means of transporting petroleum products in a country. (12 marks) 21. 2005 P2 Discuss five circumstances under which a trader may choose to transport goods by rail. (10 marks) 22. 2006 Q5a P2 a) Outline five factors that may limit the use of containers as a method of transporting goods in a developing country. (10 marks) 23. 2007 Q11 P1 State four circumstances under which air transport may be used to ferry goods (4 marks) 24. 2008 Q14 P1 Outline four factors that a trader would consider in choosing a mode of transport. (4 marks) 25. 2009 Q11 P1 Outline four factors that should be considered in the choice of a means for transporting perishable goods (4 marks) 26. 2009 Q2a P2 (a)Explain five demerits that may be associated with water transport. (10 marks) 27. 2010 Q18 P1 State four reasons why flower exporters would transport their produce by air rather than by sea. (4 marks)

<

>

GOVERNMENT AND BUSINESS;

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Postal orders

|

Money orders

|

|

It can be cashed at any post office

|

Can only be cashed at a specific post office

|

|

Are in fixed denominations

|

Varies according to the needs of the remitter

|

|

Does not require any application form to make a remittance

|

Requires the filling of an application form in making remittance

|

|

Can be cashed by the bearer

|

Can only be cashed by the payee

|

|

Value can be increased by affixing revenue stamps

|

Value cannot be increased by affixing revenue stamps

|

Postage stamps may be used to pay small amounts of money. The person to whom the stamps are sent can then use them for sending mail and/or to pay someone else.

Premium bonds are issued by the post office in denominations of sh.10 and sh.20.They mature after a given period, after which one can cash them.

Bearers can also enter into draws so as to win money.

Premium bonds can be used to settle debts, but it is not a safe method because they can be cashed by anybody i.e. by the bearer.

Circumstances under which postage stamps and premium bonds are used

- Where the amounts involved are small

- Where they are the only means available.

a. Means and payments which arise from private arrangements between the sellers and the buyers

- I Owe you (IOU)

- Bill of exchange

- Promissory note.

This is unconditional order, in writing, addressed by one person to another, requiring the person to whom it is addressed by one person to another, requiring the person to whom it is addressed to pay on demand, or at a stated future date, the sum of money on the bill to the drawer, or a named person or to a bearer.

- Order-is a command not a request

- Unconditional-Without condition i.e. no use of such words as ‘if’ or ‘whom’

- The bill must be in writing

- Amount of money must be clearly stated

- Payee must be named. He/she can be the drawer or someone else or the bearer

- Date of payment must be stated or can be determined e.g. ‘Two months from the date of today’ or Three days after 31st January 2012’

If the buyer/debtor signs the bill “accepted” then he/she cannot deny responsibility for the debt since he/she has acknowledged responsibility for the date.

Procedure for preparing a bill of exchange

Step 1.The creditor prepares the draft and sends to the debtor.

Step 2.The draft and after accepting the conditions laid therein, he/she signs on it and write the words “accepted”. He/she then sends it back to the creditor. At this point the draft becomes a bill of exchange.

Step 3.The creditor receives the bill and may:

- Keep it until maturity when he would present it to the debtor (accepted) for payment

- Discount it with a bank. This is presenting to a bank or any financial institution and receiving cash against it before the maturity date. One is however charged(discounting charge) for the service

- Negotiate it -Using it to pay someone else apart from the payee.

Parties to a bill of Exchange

- Drawer-This is the person who gives the debtor the written order to pay the value of the bill of exchange(the creditor)

- Drawee-This is the person to whom the order to pay is given (Debtor).He or she accepts the bill.

- Payee-This is the person to whom the payment is to be made. The payee may be the drawer, or

Essentials of a bill of Exchange

- It must be signed by the drawer(creditor)

- It must be accepted by the drawee(debtor)

- It must be accepted unconditionally

- It must bear appropriate revenue stamps

Advantages of using Bill of exchange

- The holder may pass rights on the bill to another person

- Date of payment is determined

- Acceptance by the debtor makes it legally binding

- The payee may receive money before due dates by discounting

Disadvantages of using a bill of exchange

- It may be dishonoured on maturity

- Cash may not be readily available as banks may be reluctant to cash bills from debtors of doubtful financial backgrounds

- It is an expensive form of credit as the creditor may lose part of the face value of bill in form of discount

Circumstances under which a bill of exchange is appropriate.

- When the creditor wants to be assured that the payment would be done

- Where the creditor wants money while the debtor is not able to raise it before the end of the credit period

- Where the creditor wants to use the debt to pay another debt.

Features of a promissory note

- There are two parties i.e. the drawer (debtor) and the payee (creditor)

- There is a promise to pay

- It is written by the debtor to the creditor

- It does not require acceptance since it is signed by the person committing to pay the money

- The writer/maker is liable on the note as he/she is the debtor.

The seller/lender may keep it until maturity and then present it for payment or may discount it with the banks before maturity.

Similarities between a bill of exchange and a promissory note:

- Both act as evidence of the acknowledgement of a debt

- Both may be discounted or endorsed before maturity

- Both are negotiable i.e. can be transferred from one person to another

- Both are legally binding

- Both allow for adequate time within which to organize for the payment of the value of the bill or note.

Differences between a promissory note and a bill of exchange

|

Promissory note

|

Bill of Exchange

|

|

Drawn and signed by the debtor

|

Drawn and signed by the creditor

|

|

It does not need to be accepted

|

It must be accepted by the debtor for it to be valid

|

|

The drawer and drawee are one person

|

The drawer is the creditor and the drawee is the debtor

|

IOU is an abbreviation of ‘I owe you’

It is a written acknowledgement by a buyer of a debt arising from the purchase of goods and services on credit. It is written and signed by the buyer and sent to the seller

If the seller accepts it, then the buyer can receive goods and services on credit.

Though the IOU does not usually indicate the specific date of payment, the buyer acknowledges the debt and accepts responsibility to pay at a suitable future date

NOTE: The use of IOU is restricted to commercial transactions involving parties who have dealt with each other for a long time; hence they know each other well.

d. Other means of payment

- Credit cards

- Mobile money transfer services e.g. M-Pesa.

These are plastic cards that enable a person to purchase goods or services on credit from any business willing to accept the card

They are both a means of payment and a term of payment

This is a means of money transfer services provided by mobile phone service providers to their customers (subscribers)

It can only be used to transfer money between people subscribed to the same mobile phone network e.g. from one safaricom subscriber to another safaricom subscriber, Airtel to Airtel etc.

The sender must register for the money transfer service and is issued with a PIN (personal identification number)

When money is sent, both the sender and the receiver will receive a message confirming the transfer.

A person can send money anytime anywhere so long as he/she has value in his/her m-pesa, pesa pap account.

Each mobile service provider has a range of value that can be transferred using this method.

A small transaction fee is charges for the transfer i.e. for sending and withdrawing

- Confidentiality-The secret PIN protects the value in the customer’s account

- Ease of use-The service is easy to use as the agents assists to carry out transaction

- Speed-Money transfer is an instant service conveyed to the receiver via the short message service(SMS)

- Convenience-The service is convenient to both the sender and the receiver, as they only need to go to the nearest agent(money can be sent/deposited or received anywhere)

- Accessibility-The agents e.g. m-pesa agents are located in most parts of towns and also in rural areas. Money can hence be sent and received anywhere and anytime.

- Affordability-The service charges are very low for registered users and very affordable for non-registered users

- Security-Relatively secure when the sender uses the correct phone number of the receiver.

A business transaction is a deal between two or more people involving exchange of goods and services in terms of money.

Business transaction may take place on cash basis; in which case goods are paid for before or on delivery or a short while after delivery

Business transaction may also take place on credit basis; which means payment is made after a specified period from the date of delivery of the goods or the provision of the services

There are various business documents that are used in various stages of business transactions as discussed below;

a) Documents used at the inquiry stage

This is the first stage in transaction. An inquiry is a request by a prospective buyer for information on available goods and services. It is aimed at establishing the following;

- Whether the goods or services required are available for sale

- The quality or nature of the products available

- The prices at which the goods or services are being sold

- The terms of sale in respect to payment and delivery of goods or services

i) Letter of inquiry;

This is a letter written by a potential buyer to the seller to find out the goods and services offered by the seller.

A letter of inquiry can be general or specific. A specific letter of inquiry seeks for information about a particular product.

Reply to an inquiry

The seller may reply to the letter of inquiry by sending any of the following documents;

- Price list

- A catalogue

- Quotation

- A tender

This is a list of items sold by the trader together with their prices. The information contained in a price list is usually brief and not illustrated and may include;

- Name and address of the seller

- List of the goods and services

- The recommended unit prices of the products

- Any discounts offered

ii) A catalogue;

A catalogue is a basket which briefly describes the goods a seller stocks.It is normally sent by the seller to the buyer when the buyer sends a general letter of inquiry. It usually carries illustrations on the goods stocked, and could be in the form of attractive and colorful pictures

The content of a catalogue includes the following;

- Name and address of the seller

- Details of the products to be sold; inform of pictures and illustrations

- The prices of the products

- After-sales services offered by the seller

- Packaging and posting expenses to be incurred

- Delivery services to be used

- Terms of sale

c) Quotation; this is a document sent by a seller to a buyer in response to a specific letter of inquiry. It specifies the conditions and terms under which the seller is willing to supply the specified goods and services to the buyer.

The content of a quotation includes the following;

- Name and address of seller

- Name and address of the buyer

- Description of goods to be supplied

- Prices of the commodities

- Terms of sale i.e. discounts, time of supply, delivery

- Total of the goods to be supplied

d) A Tender

This is a document of offer to sell sent by a seller to a buyer in response to an advertised request

Tenders contain the following;

- Date when the tender advertisement was made

- Mode of payment

- Date of making document

- Discounts given

- Name and address of prospective seller called the tenderer

- The prices at which the goods can be provided

- Period of delivery

- Mode of delivery

The winning tender is usually awarded on the of the lowest quoted price although the buyer is not obliged to accept this especially if quality is likely to be low

Tenders are not binding unless accepted by the buyer.

After receiving replies to inquiry in form of price list, catalogue or Quotation, a prospective buyer will study the terms and conditions stated in them, and then may decide to buy products or not.

i) An Order

If a prospective buyer decides to purchase an item(s), he or she then places an order

An order is a document sent by a potential buyer to a seller requesting to be provided with specified products under specified terms and conditions

An order issued for goods is called a local purchase order (LPO)

An order issued for services is called a local service order (LSO)

Ways of making an order

- Filling an order form. This is a pre-printed document that is used for making orders

- Writing an order letter

- Sending an e-mail, faxing or sending a short text message

- Giving a verbal order. Verbal orders have the disadvantage in that they can be misunderstood and there would be no record of items ordered

A written order may contain the following;

- Name and address of the buyer

- Name and address of the seller

- The number of the order

- Quantities ordered and total amount to be paid

- Description of the goods ordered

- Price per item

- Special instructions on such matters as packaging and delivery

On receiving the order, the seller sends the buyer an acknowledgement note

An acknowledgement note is a document sent by the seller to the prospective buyer to inform him/her that the order has been received and it is being acted upon.

After sending the acknowledgement note, the seller has to decide whether to extend credit to the buyer or not. At this stage, the seller has the following options;

- If the seller is convinced that the buyer is credit worthy, arrangements are made to deliver the ordered goods or services to the buyer.

- If the seller is not sure of credit worthiness of the buyer, a credit status inquiry can be issued to the buyer’s bankers or to other suppliers who deal with the buyer to ascertain the credit worthiness.

- If the buyer is not creditworthy, then a polite note or a proforma invoice can be sent to him/her

A proforma invoice

Functions of a proforma invoice

- A polite way of asking for payment before the goods are delivered

- Sent when the seller does not want to give credit

- Used by importers to get customers clearance before goods are delivered

- Issued to an agent who sells goods on behalf of the seller

- Show what the buyer would have to pay if the order is approved

- Can be used to serve as a quotation

Circumstances under which a pro-forma invoice may be used

- If the seller does not want to give credit

- If the seller wants to sell goods through an agent

- If the seller wants to get clearance for imported goods

- If the seller wants it to function as a quotation

- If the seller wants to inform the buyer what he/she pay if the order is approved etc.

Documents used at the Delivery stage

- The seller can ask the buyer to collect the goods

- The seller can deliver the goods to the buyer using his/her own means of transport

- The goods can be delivered to the buyer through public transport

- The services(s) can be rendered to the buyer at the sellers or the buyer’s premises or at any convenient place.

i) Packing note; before delivery goods are packed for dispatch. This is a document prepared by the seller showing the goods contained/packed in every container, box or carton being delivered to the buyer. A copy of the packing note is packed with the goods to make/help the buyer have a spot check.

The contents of a packing note include;

- Description of goods packed

- Quantities of goods packed

- The means of delivery

ii) Advice note; this is a document sent by the seller to the buyer to inform the buyer that the ordered goods have been dispatched. It is usually sent through the fastest means possible.

- It contains the following;

- The means of delivery

- A description of the goods

- The quantity dispatched

- Date

- Name and address of buyer and seller.

Functions of an advice note

- Informing the buyer that the goods are on the way so that in case of any delay in delivery, the buyer can make inquiries.

- Alerting the buyer so that necessary arrangements can be made for payments when the goods arrive

- Can serve as an acknowledgement note, where one is not sent

When the goods reach the buyer, he/she confirms that the goods are the ones ordered for and that they are in the right condition by comparing the delivery note, the order and the goods. If the buyer is satisfied with the goods, he/she signs the two copies, retains the original and send the copy back to the seller. This serves as evidence that the goods have been received in the right condition and in the right quantities.

Some businesses keep delivery books in which the buyer signs to indicate that goods have been received in good condition. A delivery book is used by the seller if he/she delivers goods by himself/herself as an alternative to a delivery note

- Name and address of the seller

- Name and address of the buyer

- Date of delivery

- Delivery note number

- Description of the goods delivered

- Quantities of the goods delivered

- Space for the buyer to sign and comment on the condition of the goods received.

This is a document prepared by a transporter to show that he/she has been hired to deliver specified goods to a particular buyer. This document is used when goods are delivered to the buyer by public means of transport e.g. by trains.

The seller is the consignor, the buyer is the consignee and the goods the consignment

The transporting company prepares the consignment note and gives the seller to complete and sign. The seller then returns the note to the transporter (carrier) who takes it together with the goods to the buyer.

On receiving the goods, the buyer signs the consignment note as evidence that the goods were actually transported.

The content of a consignment note includes the following;

- Details of the goods to the transported

- Name address of seller (consignor)

- Name and address of buyer (consignee)

- Terms of carriage and conditions of transporting the goods

- The transportation cost

- Handling information

- Destination of goods

The contents of the goods received note include;

- Date of the document

- Name and address of the buyer

- Name and address of the seller

- Corresponding purchase order

- Details of goods received

- Date the goods were received.

- Wrong type of goods

- Excess goods

- Wrong quality goods

A goods returned note is a document sent by a buyer to a seller to inform him/her that certain goods are being returned to the seller.

Where the goods are returned because of damage, the note may be referred to as the damaged goods note.

The contents of the goods returned note include;

- Details of goods that have been returned to the seller

- Date goods are returned

- The number of (GRN)

- Order number

- Delivery number

- Name and address of both buyer and seller

This stage involves the seller requesting or demanding for payment from the buyer for the goods or services delivered.

Some of the documents used at this stage include;

a) Invoice

This is a document sent to the buyer by the seller to demand for payment for goods delivered or services rendered.

There are two types of invoices namely;

- Cash invoice-This is sent when payment is expected immediately after delivery thus acting as a cash sale receipt

- A credit invoice-This is sent when a buyer is allowed to pay at a later date.

Functions of an invoice

- It shows the details of goods sold i.e. quantity delivered, unit price, total value of the goods and terms and conditions of sale.

- It is a request to the buyer to make payment

- It serves as an evidence that the buyer owes the seller a certain amount of money

- It is used as a source document in recording the transaction in the book of accounts.

- Invoice number

- Name and address of the seller

- Name and address of the buyer

- Date document is prepared

- Details of goods repaired

- Unit prices of goods delivered

- Total value of goods

- Discounts offered

- E and O.E printed at the bottom

On receiving the invoice, the buyer verifies the contents using the local purchase order and the delivery note. If the invoice is in order, the buyer makes arrangements to pay the amount stated.

Businesses which offer services issue a document called a bill, which serves the purpose of an invoice.

Differences Between the invoice and pro-forma invoice

The invoice |

The pro-forma invoice |

It is issued after goods and services have been delivered |

It is issued before goods and services have been delivered |

It shows the total value of the goods or services on credit |

Shows the total value of goods and services to be bought |

It is used to demand payment for products sold on credit |

It is used to demand for payment in advance for products to be bought |

Used as a basis for making payment for products already bought |

Used as a basis for preparing payment for products not yet bought |

Serves as a notice of payment for products bought on credit |

Serves as a Quotation for products to be bought. |

This is a document sent by the seller to the buyer (credit buyer) to correct an overcharge. It is used to inform the buyer that the amount payable by him/her has been reduced

An overcharge is an excess amount charged beyond the right price.

Causes of overcharge may include;

- Arithmetical errors like wrong addition

- Price overcharges

- Inclusion of wrong or unordered items in the invoice

- Failure to deduct the allowable discounts

- Return of goods (damaged goods)

- Failure to note the return by the buyer of packing cases or containers used to deliver goods to him/her

- Use of wrong price list.

A credit note is usually printed in red to distinguish it from other documents.

Contents of a credit note include;

- Name and address of the seller and the buyer

- Credit note number

- Date document is prepared

- Description and value of goods returned by buyer (in case that was done)

- Total overcharge

Reasons why a seller would send a credit note to a buyer/circumstances under which a credit note is sent to a buyer.

- When there is an overcharge in an invoice

- When the original invoice had indicated items that were not supplied

- When the buyer returns empty cases/crates that had been charged in the invoice.

- When the buyer returns some goods to the seller

- If the buyer was entitled to a discount which was not given or taken care of in the invoice.

This is a document sent by the seller to the buyer to correct an undercharge on the original invoice. It is used to inform the buyer that the amount payable by him has been increased.

A debit note acts as an additional invoice.

An undercharge arises when amount charged on products is less than their right price.

Causes of undercharge include;

- Price undercharges on items

- Arithmetic errors/mistaken in calculation

- Omission of items in the invoice

- Retention of crates and containers that were not involved by the buyer

- Deductions of more discount than what was give/intended

Circumstances under which a debit note will be sent to the buyer

- When there is an undercharge in the invoice

- If the buyer had been given a discount that was not due to him

- If some items had been omitted in the original invoice

- If the buyer decides to retain some empty containers or crates

Differences Between a debit note and a credit note

DEBIT

NOTE |

CREDIT NOTE |

Issued to correct an undercharge on the invoice. |

Issued to correct an overcharge on the invoice. |

Written on blue or black. |

Usually written in red |

Issued when containers have not been returned |

Issued when containers have been returned. |

Documents used at the payment stage

The documents used at the payment stage include:

This is a document issued to the buyer by the seller as proof that payment has been made.

Payment can be done in cash, cheque, other forms of money or in kind

The receipt also serves as a source document for making entries in books of accounts.

Contents of the receipt include;

- Date of payment

- Name of the person making payment

- Name of person/institution receiving payment

- Amount paid in words and figures

- Means of payment

- Receipt number

- Signature of person issuing the receipt.

A receipt serves the same purpose as the cash sale slip

This is a document prepared by the seller and sent to the buyer, giving a summary of all the dealings/transactions between them during a particular period of time, usually a month. It has the following details;

- Date when it was prepared

- Name and address of the seller

- Name and address of the buyer

- Account number

- Date column-where the date of each transaction is recorded

- Particulars (Details)column-where the explanation of each transaction is shown

- Money column

Credit column-Decrease in the amounts payable due to overcharges corrected or payments recorded.

Balance column-Amount owing after each transaction (Balance outstanding)

- Any discounts allowed to the buyer

- Date when the buyer is expected to clear the balance

- Terms of credit etc.

An IOU (I owe you) is a document written by the buyer and sent to the seller to acknowledge a debt.

- It does not specify date when settlement will be made.

- It acts as evidence that a debt exists.

Summary of documents used in home trade

Document sent by buyer |

Document sent by seller |

Letter of inquiry |

Price list |

Order |

Catalogue |

Goods received note |

Quotation |

Goods returned note |

Tender |

IOU |

Acknowledgement |

Advice note |

|

Packaging note |

|

Delivery note |

|

Consignment note |

|

Invoice |

|

Pro forma invoice |

|

Credit note |

|

Debit note |

|

Receipt |

|

Statement of account |

There are wholesalers who carry out retailing but that do not make them retailers.

Classification of wholesalers/Types of wholesalers

- According to the range of goods they handle

- According to the geographical area in which they operate

- According to their method of operation.

Under this classification, wholesalers may be any of the following;

- General merchandise wholesalers

- General line wholesalers

- Specialized wholesalers

The word merchandise means goods.

The general merchandise wholesalers stock and sell a wide variety of goods e.g. hardware, clothes, cosmetics and foodstuffs. The retailers who buy from these wholesalers are thus able to get a wide variety of goods for resale.

They are also called general wholesalers or full-line wholesalers

b) General line wholesalers

These are wholesalers who deal in a wide variety of goods within the same line e.g. textbooks, duplicating papers and other types of stationary.

c) Specialized wholesalers

These are wholesalers who deal in a particular good from a given line e.g. in the line of grains, they may specialize in maize only.

Under this category wholesalers may be;

- Nationwide wholesalers

- Regional wholesalers.

These are wholesalers who supply goods to traders in all parts of the country.

They establish warehouses or depots in different areas from Kenya National Trading Corporation (KNTC)

b) Regional Wholesalers

These are wholesalers who supply goods to certain parts of the country only. They may cover a county, District, division etc.

Under this classification, wholesalers can be;

- Cash and carry wholesalers

- Mobile wholesalers

- Rack jobbers

b) Mobile wholesalers/Track distributors; these are wholesalers who use vehicles to move from place to place supplying goods to retailers e.g. soda distributors, bread distributors, beer distributors etc.

c) Rack jobbers

These wholesalers specialize in selling certain/particular products to other specialized wholesalers. They buy goods from producers or from other countries for reselling.

E.g. some wholesalers buy horticultural products from producers and sell to other wholesalers in urban areas

Rack jobbers usually stock their goods in shelves or racks from which customers select the goods to buy. Customers may be allowed to pay for the goods after they have sold them.

d) Drop shippers

These are wholesalers who make orders for goods from manufacturers/producers but do not take them from the producer’s premises. They then look for the buyers for the goods and supply the goods directly from the producers

Alternate classification of wholesalers

- Those who buy goods store them in warehouses and sell them to traders without having added anything to them.

- Wholesalers who act as wholesaler’s agents or brokers. These are middlemen who are paid a commission for their work e.g. commission agents

- Those who after buying the goods and storing them prepare them for sale. They break bulk, pack, brand, sort, grade and blend the goods

- Breaking bulk-Reducing a commodity into smaller quantities for the convenience of the buyer e.g. buying sugar from the producer in sacks and selling it in packets.

- Packing-Putting goods in packets and boxes ready for sale.

- Branding-Giving a product a name by which it will be sold

- Sorting-Selecting goods to desired sizes, weight, colour and qualities

- Grading-Putting goods in groups of similar qualities to make it easier to price them

- Blending-It involves mixing different grades of a product to achieve qualities like taste and colour.

Functions of a wholesaler

Services of wholesalers to the producers

- They relieve the producers the problem of distribution by buying goods from them and selling to retailers

- They relieve the producers of some risks they would experience e.g. damage, theft, fall in demand etc.

- Save the producers from the problem of storage by buying goods and keeping in their warehouses

- They prepare goods for sale on behalf of the producers

- They get feedback from consumers on behalf of producers

- They promote products through advertising, displays, trade fairs and exhibitions

- They finance producers by buying goods from them and paying in cash.

- They stock a wide variety of goods in large quantities relieving the retailer from buying from different producers

- They avail goods at places convenient to retailers

- They break bulk for the benefit of retailers

- They offer transport facilities to retailers

- They offer advisory services to retailers regarding market trends

- They offer credit facilities to retailers

- They engage in product promotion on behalf of retailers

- They sort, blend, pack and brand goods saving retailers from having to do it.

- They ensure a steady supply of goods to retailers hence consumers are not faced with shortages

- They ensure a stable supply of goods hence there will be stability in market prices

- They enable consumers to enjoy a wide variety of goods

- They break the bulk of goods thus enabling the consumer through the retailer to get the goods in convenient quantities

- They prepare goods for sale e.g. branding, blending and packaging

- Pass information to consumers through retailers about the goods e.g. new products, new prices and their use.

Classification of Retail Trader

- Small scale retailers

- Large scale retailers

1. Small-scale Retail businesses/small scale Retailers

Small scale businesses are easy to start and in most cases they are operated as one-man’s business.

A small scale trader serves the needs of people in the immediate neighborhood and deal mainly in fast moving goods such as foodstuffs, detergents, kerosene etc.

Categories and Types of small scale

a) Small scale Traders without shops

- Itinerant Traders (Hawkers and peddlers)

- Roadside sellers

- Open air market Traders

- Single shops

- Tied shops

- Kiosks

- Mobile shops

- Market stalls

- Canteens

- Mail order stores

a) Small scale Retailers without shops

These are retailers who move from place to place selling their goods either on foot, by bicycles or motor cycles

They move from town to town, door to door and from village to village selling their goods. Their goods may include clothes, utensils and foodstuffs. Customers can buy goods without having to travel to look for them

Examples of itinerant traders are hawkers and peddlers (Hawkers move around on bicycles, handcarts or motorcycles while peddlers walk around)

The itinerant traders require a license from the local authorities in order to sell their goods.

Characteristics of itinerant Traders

- Are found mainly in densely populated areas

- Move from place to place in search of customers

- They are very persuasive

- Their prices are not controlled.

- They require little capital to start

- They are convenient because they bring goods closer to the people

- The business is flexible in that they can move from place to place. They can also change from line of business to another

- Few legal formalities are required

- They usually do not suffer bad debts because they sell in cash.

- The traders get tired because of moving from one place to another while carrying goods.

- The business is affected by bad weather conditions

- The traders sale a limited range of goods

- It is difficult to transport goods from one place to another.

- Do not offer guarantee, in case items are to be found defective

- They are constantly in conflict with the local government.

These are traders who sell their goods at places where other people pass by and at busy places such as along busy roads, bus stages, road junctions and entrances to public buildings.

They place their goods on trays, cardboards, empty sacks and mails

They sell items such as fruits, utensils, sweets, clothing and some hardware.

iii. Open-air market Traders.

Open air markets are places set aside by the government through the local authorities where people meet to buy and sell goods. Traders selling similar commodities are allocated a special area. Such markets are open on particular days of the week.

The variety of goods sold here is wide and include agricultural produce, clothing, household items, animals, foodstuffs and even furniture.

The traders move from one market to another depending on the various market days.

Advantages of small-scale retailers without shops

- They require a small amount of capital to start and operate their businesses.

- They are convenient since they take goods to the customers within their reach.

- They incur low costs of doing business

- Most of their goods are low-priced and hence more affordable to customers.

- The business is flexible. It is easy to change from one business to another

- They require few legal requirements

- The financial risks involved in these businesses are minimal

- They do not suffer bad debts since they sell on cash bases

- They interact at personal level with the customers and can convince them to buy their goods.

- It is tiring for traders to move from place to place especially if the goods are heavy and the distance covered are long

- The traders face stiff competition from other traders with more resources

- They offer a limited variety of goods

- They are affected by unfavorable weather condition