LATEST BUSINESS STUDIES NOTES

Outline four requirements for one to start a limited liability company as one of the forms of business units. (4 mks)

0 Comments

<

>

Business UnitsA business unit is an organization formed by one or more people with a view of engaging in a profitable activity.

Note: Private sector comprises of business organizations owned by private individuals while the public sector comprises business organizations owned by the government 1. Sole ProprietorshipThis is a business enterprise owned by one person who is called a sole trader or a sole proprietor. It is the most common form of business unit and usually found in retail trade e.g. in small shops, kiosks, agriculture etc. and for direct services e.g. cobblers saloons etc.

Characteristics/FeaturesThe business is owned by one person

The capital is contributed by the owner and is usually small. The main source is from his savings and other sources can be from friends, bank or getting an inheritance The owner enjoys all the profits alone and also suffers the losses alone The owner is personally responsible for the management of the business and sometimes he is assisted by members of his family or a few employees. He remains responsible for the success or failure of his/her business. The sole proprietor has unlimited liability meaning that incase of failure to meet debts, his creditor can claim his personal property There are very few legal requirements to start the business unit. Sole proprietorship is flexible; it is very easy to change the location or the nature of business. FormationThe formation of a sole proprietorship is very simple. Few legal formalities are required i.e. to start a sole proprietorship, one need only to raise the capital required and then apply for a trading license to operate the business small fee is paid and the trade license issued.

Sources of capitalThe amount of capital required to start a sole proprietorship is small compared to other forms of business organizations. The main source of capital is the Owners savings. Additional capital may however be raised from the following;

ManagementThe management of this kind of a business is under one person. The owner may however employ other people or get assistance from family members to run the business.

Some sole proprietorship may be big business organizations with several departments and quite a number of employees. However, the sole proprietor remains solely responsible for the success of failure of the business Advantages of sole proprietorship

Disadvantages of sole proprietorship

Dissolution of sole proprietorshipsDissolution refers to the termination of the legal life of a business. The following circumstances may lead to the dissolution of a sole proprietorship:

2. PartnershipThis is a relationship between persons who engage in a business with an aim of making profits/ an association of two or more persons who run a business as co-owners. The owners are called Partners.

It is owned by a minimum of 2 and a maximum of 20 except for partnership who provide professional services e.g. medicine and law which have a maximum of 50 persons. Characteristics of partnership

Types of partnershipPartnerships can be classified/ categorized in either of the following ways:

Under this classification, partnerships can either be; i) General/ordinary partnership- Here all members have unlimited liability which means in case a partnership is unable to pay its debts, the personal properties of the partner will be sold off to pay the debts. ii) Limited partnerships- In limited partnership members have limited liabilities where liability or responsibility is restricted to the capital contributed. This means that incase the partnership cannot pay its debts; the partners only lose the amount of capital each has contributed to the business and not their personal property. However, there must be one partner whose liabilities are unlimited. (b) According to the period/duration of operation When partnerships are classified according to duration of operation, they can either be; i. Temporary partnership - These are partnerships that are formed to carry out a specific task for a specific time after which the business automatically dissolves. ii. Permanent partnerships - These are partnerships formed to operate indefinitely. They are also called a partnership at will. (c) According to their Activity- Under this mode of classification, partnerships can either be:

Classification of partnersPartners may be classified according to;

i) Role played by the partners

FormationPeople who want to form a partnership must come together and agree on how the proposed business will be run to avoid future misunderstanding.

The agreement can either be oral (by use of mouth) or within down. A written agreement is called a partnership deed. The contents of the partnership deed vary from one partnership to another depending on the nature of the business, but generally it contains;

In case a partnership deed is not drawn, the provisions of partnership act of 1963 (Kenya) applies. The act contains the following rights and duties of a partner;

Sources of capital

Advantages of partnership

Disadvantages of partnership

Dissolution of partnershipA partnership may be dissolved under any of the following circumstances:

Incorporated Forms of Business Units

These are businesses that have separate legal entities from that of their owners. They include:

c. Co-OperativesA co-operative society is a form of business organization that is owned by and run for the economic welfare of its members

It is a body of persons who have joined together to do collectively what they were previously doing individually for mutual benefit. Example In Kenya the co-operative movement was started by white settlers in 1908 to market their agricultural produce. In this case, they knew that they could sell their produce better if they were as a group and not alone Principles of co-operativesi) Open and voluntary membership

Membership is open and voluntary to any person who has attained the age of 18 years. No one should be denied membership due to social, political, tribal or religious differences. A member is also free to leave the society at will ii) Democratic Administration The principle is one man one vote. Each member of the co-operative has only one vote irrespective of the number of shares held by him or how much he buys or sells to the society iii) Dividend or repayment Any profit/surplus made at the end of every financial year should be distributed to the members in relations to their contribution. Part of the profit may be retained/reserved/put in to strengthen the financial position of the society. iv) Limited interest on share capital A little or no interest is paid on share capital contributed (co-operatives do not encourage financial investment habits but to enhance production, to encourage savings and serve the members) v) Promotion of Education Co-operative societies should endeavor to educate their members and staff on the ideas of the society in order to enhance/improve quality of decisions made by the concerned parties. Education is conducted through seminars, study tours, open days vi) Co-operation with other co-operatives C-operatives must learn from each other’s experience since they have a lot in common. Their co-operation should be extended to local national and international. Features of co-operatives

FormationCo-operative societies can be formed by people who are over eighteen years regardless of their economic, political or social background.

There must be a minimum of 10 persons and no maximum no. The members draft rules and regulations to govern the operations of the proposed society i.e. by-laws, which are then submitted to the commissioner of co-operatives for approval The registrar then approves the by-laws and issues a certificate of registration If the members are unable to draw up their own by-laws, the co-operative societies Act of 1966 can be adopted in part or whole ManagementA co-operative society is composed/run by a committee usually of nine members elected by the members in a general meeting

The management committee elects the chairman, secretary and treasurer as the executive committee members, who act on behalf of all the members and can enter into contracts borrow money institute and depend suits and other legal proceedings for the society The committee members can be voted out in an A.G.M if they don’t perform as expected. Types of Co-Operatives Societies in KenyaMay be grouped according to;

i) Nature of their activities

A) Producer co-operativesThis is an association of producers who have come together to improve the production and marketing of their products.

Functions

Examples, KCC-Kenya Co-operative Creameries K.P.C.U-Kenya Planters Co-operatives Union K.G.G.C.U-Kenya Grain Growers Co-operative Union b) Consumer Co-operativesThese are formed by a group of consumers to buy goods on wholesome and sell them to the members at existing market prices.

Their aim is to eliminate the wholesalers and retailers and hence obtain goods more cheaply The co-operatives allow their members to buy goods on credit or in cash Members of the public are also allowed to buy from the society at normal prices thereby enabling the society to make more profits The profits realized is shared among the members in proportion to their purchases i.e the more a member buys, the buyer his/her share of profit Examples;-Nairobi consumer co-operative union, Bee-hive consumer co-operative society and City-chicken consumer co-operative society Advantages

DisadvantagesConsumer co-operatives are not popular in Kenya because of the following

Savings and credit co-operatives societies (SACCO’S)They are usually formed by employed persons who save part of their monthly salary with their co-operative society, through check-off system

Their money earns goods interest and when one has a significant amount saved, he/she become entitled to borrow money from the society for any personal project e.g. improving their farms, constructing houses, paying school fees etc. The SACCOS charge lower interest on loans given to members than ordinary banks and other financial institutions. The societies have few formalities or requirements to be completed before giving a loan. These are:

Most SACCO’S have insured their members savings and loans with co-operative insurance services (CIS).This means if a member dies his/her beneficiaries are not called upon to repay the loan and the members savings/shares is given to the beneficiaries. They are the main institutions that provide loans to most people who do not qualify for loans from commercial banks because they do not ask for securities such as title deeds required by the bank. Primary co-operative societiesThese are co-operative societies composed of individuals who are either actual producers, consumers or people who join up together to save and obtain credit most conveniently

Consumer co-operative societies and most SACCO’S are primary co-operative societies because they are composed of individuals. Most primary co-operative societies operate at the village level, others at district levels and a few at national levels. Secondary co-operative societiesThey are usually referred to as unions

They are generally composed of primary co-operative societies as their members They are either found at district levels or at national levels. Advantages of co-operative societies;

Disadvantages

Dissolution of co-operative societiesA co-operative society may be dissolved under any of the following circumstances.

Limited Liability Companies (Joint Stock Companies)Definition: A company; is an association of persons registered under the company’s act who contribute capital in order to carry out business with a view of making a profit.

The act of registering a company is referred to as incorporation. Incorporation creates an organization that is separate and distinct from the person forming it. A company is a legal entity that has the status of an ‘’artificial person”. It therefore has most of the rights and obligations of a human being. A company can therefore do the following;

Features of Companies (Limited Liability Companies)A company in an artificial person and has the same rights as a natural person. It can therefore sue and be sued in a court of law, own property and enter into contracts in its own name.

The members have limited liabilities. Companies have perpetual life which is independent of the lives of its owners. Death, insanity or bankruptcy of a member does not affect the existence of the company. (This is referred to as perpetual existence or perpetual succession) A company is created for a particular purpose or purposes. FormationPeople who wish to form company are referred to as promoters

The promoters submit the following documents to the registrar of companies: i) Memorandum of Association This is a document that defines the relationship between the company and the outsiders. It contains the following: a) Name of the company/Name clause; -The name of the company must be started and should end with the word “Limited” (Ltd).This indicates that the liability of the company is limited. Some companies end their names with “PLC” which stands for “Public limited company” which makes the public aware that although it is a limited liability company it is a public not private. b) The objects of the company/objective clause;-This set out the activities that the company should engage in The activities listed in this clause serve as a warning to outsiders that the company is authorized in these activities only. c) Situation clause;-Every company must have a registered office where official notices and other communication can be received and sent d) Capital clause;-It also states that the amount of capital which the business can raise and the divisions of this capital into units of equal value called shares i.e. authorized share capital also called registered or nominal share capital. It also specifies the types of shares and the value of each share e) Declaration clause:-This is a declaration signed by the promoters stating that they wish to form the company and undertake to buy shares in the proposed firm The declaration is signed by a minimum of seven promoters for public limited company and a minimum of two for private company. The memorandum of association also contains the names of the promoters The promoters signs against the memorandum showing details of their names, addresses, occupation and shares they intend to buy. Each signatory should agree to take at least one share. ii) Articles of Association This is a document that governs the internal operations of the company It also contains rules and regulations affecting the shareholders in relation to the company and in relation to the shareholders themselves. It contains the following;

iv) Declaration that registration requirements as laid down by law (by the companies act) have been met. The declaration must be signed by the secretary or a director or a lawyer. v) A statement signed by the directors stating that they have agreed to act as directors. vi) A statement of share capital- this statement gives the amount of capital that the company wishes to raise and its subdivision into shares. Once the above documents are ready, they are submitted by the promoters to the registrar of companies. On approval by the Registrar and on payment of a registration fee, a certificate of incorporation (certificate of registration) is issued The certificate of incorporation gives the company a separate legal entity. Sources of capital1. Shares; the main source of capital for any company is the sale of shares.

A share is a unit of capital in a company e.g. if a company states that its capital is ksh.100, 000 divided into equal shares of ksh.10 each. Each shareholder is entitled to the company’s profit proportionate to the number of shares he/she holds in the company. Types of shares

Ordinary shares have the following rights:

They have the following characteristics;

2. Debentures

This refers to loans from the public to a company or an acknowledgement of a debt by a company They carry fixed rate of interest which is payable whether profit are made or not. They are issued to the public in the same way as shares. They can be redeemable or irredeemable. Redeemable debentures are usually secured against the company’s assets in which case they termed as secured debentures or mortgaged debentures. NB: Where no security is given, the debentures are called unsecured /naked debentures. 3. Loans from bank and other financial institutions;-A company can borrow long term or short term loans from banks and other money lending institutions such as Industrial and Commercial Development Corporation [I.C.D.C] 4. These loans are repayable with interest of the agreed rates. 5. Profits ploughed back;-A company may decide to set aside part of the profit made to be used for specified or general purposes instead of sharing out all the profit as dividends. This money is referred to as a reserve. 6. Bank overdraft;-A customer to a bank may make arrangements with the bank to be allowed to withdraw more money than he/she has in the account. 7. Leasing and renting of property. 8. Goods brought on credit. 9. Acquiring property through hire purchase. Types of Companiesd. Private Limited Company

Private limited company has the following characteristics;

FormationIt must have a memorandum of association, article of association list of directors, declaration signed by a director or lawyer and certificate of incorporation.

Advantages of private limited companyi)Formation: The Company can be formed more easily than a public company. The cost of information is less than that of a public company

ii)Legal personality: A private company is a separate legal entity from its owners. Like a person, it can own property, sue or be Sued and enter into contacts iii)Limited liability: Shareholders have limited liability meaning that they are not responsible for the company’s debts beyond the amount due on the shares iv)Capital: They have access to a large pool of capital than sole proprietorship or a partnership. They can borrow money more easily from financial institutions because it owns assets which can be pledge as security v)Management: A private company has a larger pool of professional managers than a sole proprietorship or a partnership. These managers bring in professional skills in their own areas which are of great advantage to a private company vi)Assured continuity of the business: Death, bankruptcy or withdrawal of a shareholder does not affect the continuity of the company vii)Trading: Unlike a public company a private company can commence trading immediately upon receiving a registration certificate. Disadvantages of a private companyi)Returns: A private company, unlike sole proprietorship or a partnership, must submit annual returns on prescribed forms to the registrar of companies immediately after the annual general meeting

ii)Capital: A private company cannot invite the public to subscribe to its shares like a public limited company. It therefore limited access to a wide source of capital. iii)Share transfer: The law restricts the transfer of shares to its members/shareholders are not free to transfer their share e. Public Limited Company

Public limited companies have the following characteristics:

Advantages of public limited companyi) Wide range of sources of capital :It has access to wide range of sources of capital especially through the sale of shares and debentures

They can also borrow money from financial institutions in large sums and have good security to offer to the lenders. ii) Limited liability: Like private companies, public limited company’s shareholders have limited liability i.e. the shareholders are not liable for the company’s debts beyond the shareholders capital contribution. iii) Specialized management: PLC’S are able to hire qualified and experienced professional staff. iv) Wide choice of business opportunities: Due to large amount of capital a public company may be suitable for any type of investment v) Share transferability: Shares are freely transferable from one person to another and affects neither the company’s capital nor its continuity. vi) Continuity: PLC has a continuous life as it is not affected by the shareholders death, insanity, bankruptcy or transfer of shares vii) Economies of scale: Their large size enables them to enjoy economies of scale operations. This leads to reduced costs of production which raises the levels of profit viii) Employee’s motivation: They have schemes which enable employees to be part owners of the company which encourages them to work harder in anticipation of higher dividends and growth in the value of the company’s shares. ix) Share of loss: Large membership and the fact that capital is divided into different classes’ means that the risk of loss is shared and spread. x) Shareholders are safe guarded; Publicity of company accounts safeguard against frauds. Disadvantages of public limited companiesi) High costs of formation: The process of registering a public company is expensive and lengthy. Some of the costs of information are legal costs, registration fees and taxes

ii) Legal restrictions: A public company must comply with many legal requirements making its operations inflexible and rigid iii) Alienation of owners: Shareholders non-participation in management is a disadvantage to them iv) Lack of secrecy: The public limited companies are required by law to submit annual returns and accounts to the registrar of companies denying the company the benefit of keeping its affairs secret. They are also required to publish their end of year accounts and balance sheets. v) Conflicts of interests: Directors may have personal interests that may conflict with those of the company. This may lead to mismanagement. vi) Decision making; Important decision are made by the directors and shareholders. The directors and shareholders meet after long periods which make decision making slow/delayed and expensive. vii) Diseconomies of scale: The large size and nature of business operations of public limited companies may result in high running/operation costs and inefficiency viii) Double taxation: There is double taxation since the company is fixed and dividends distributed to the shareholders are also taxed ix) Inflexibility: Public limited companies cannot easily change its nature of business in response to the changing circumstances in the market. All shareholders must be consulted and agree. Dissolution of a CompanyThe following are the circumstances that may lead to the dissolution of a company:

The Role of Stock Exchange as a Market for SecuritiesDefinitions

A person wishing to acquire shares will do so either at an IPO or in the secondary market. However, an investor cannot buy or sell stocks directly in the stock exchange market. They can only do so through stock brokers. Roles of the Stock Exchange Market

f. Public Corporations (State Corporations)These are organizations formed by and/or controlled by the government (the government has a controlling interest). This means that the government owns more than 50% shares in the corporation. Where the government has full ownership, the organization is known as a parastatals

Characteristics/features of public corporations

FormationSome are formed by an act of parliament while others are formed under the existing laws.

When formed by an act of parliament, the Act defines its status obligations and areas of operation. The Act outlines the following;

ManagementThe public corporations are managed by a board of directors appointed by the president or the relevant minister.

The chairman and the board of directors are responsible for the implementation of the aims and objectives of the corporations. The chairman of the board of directors reports to the government (president) through the relevant minister. The managing director who is usually the secretary of the board of directors in the chief executive officer of the corporation Sources of capital

Advantages of public corporations

Disadvantages of public corporations

Dissolution of public corporationsThey can only be dissolved by the government due to;

7. Parastatals

A parastatal is a state cooperation which is owned by the government The formation, management, source of capital and dissolutions are discussed above Trends in Forms of Business Unitsa. Globalizations

This refers to the sharing of worlds resources among all regions i.e. where there are no boundaries in business transactions Some companies referred to as multinationals, have branches in many parts of the world e.g. Coca-Cola Company Globalization has been made possible and effective through the development and improvement of information and technology organization i.e.

This occurs when two independent business enterprises combine to form one large organization Levels of combinations i)Vertical combination; This is when businesses engaged in different but successive levels of production combine e.g. primary(extractive) level combines with secondary(manufacturing)level or secondary level combining with tertiary level. Example; A company producing cotton (raw materials) combining with a textile industry. ii)Horizontal combination; this is where business enterprises of the same level combine e.g. secondary and secondary levels etc. Types of Amalgamation/combinationAmalgamations whether vertical or horizontal can be achieved in these ways;

a) Holding companies A holding company is one that acquires 51 percent or more shares in one or more other companies. The various companies entering into such a combination are brought under a single control. These companies are controlled by the holding company and are called Subsidiaries. The subsidiary companies are however allowed to retain their original names and status, but the holding company appoints some members to be on the board of directors of these subsidiaries, so as to control their activities. Holding companies are usually financial institutions because they are able to buy controlling shares in subsidiary companies b) Absorptions (takeovers) This refers to a business taking over another business by buying all the assets of the other business which then ceases to exist. Example; Kenya Breweries took over the castle company in Kenya c) Mergers( Amalgamation); This is where two or more business organizations combine and form one new business organizations. The merging companies cease to exist altogether. d) Cartels This is a group of related firms/ companies that agree to work together in order to control output, prices and markets of their products – O. P. E. C (organization of petroleum exporting countries) is an example. d) Privatization; This is the process of transferring / selling state owned corporations to public limited companies or private investors. This is done by the Government selling their shareholding to members of the public. The main aim is to:

(f) Burial Benevolent Funds (B. B. F); some SACCOS have started systems / funds to assist their members financially in burials through creation of BBF. (g) Front Office Savings Account (FOSA); SACCOS have expanded their services to members by introducing FOSA. The account enables members to conveniently deposit and withdraws money. A member may also be provided with an ATM card which enables him/her to withdraw money at various pesa points/ ATM’s. Franchising ; this is where one business grants another the rights to manufacture, distribute or produce its branded products using the name of the business that has granted the rights eg General motors’ has been granted franchise to deal in Toyota, Isuzu and Nissan vehicles. Trusts; this is where a group of Companies work together to reduce competition. Trusts may also be formed where a company buys more than 50% of shares in a competing company so as to reduce competition. Performance contracts; Employees in state corporations are expected to sign performance contracts in order to improve their efficiency. Other private institutions are also adopting the same practice. forms of business units questions & answers1995 P1

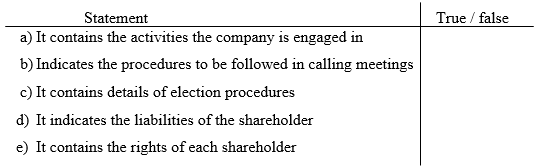

In the spaces provided, indicate by writing true or false whether each of the following statements is true or false about articles of association of a company. (5 marks) 1995 P2

Explain five principles under which cooperative societies should be managed (10 marks) 1995 P2

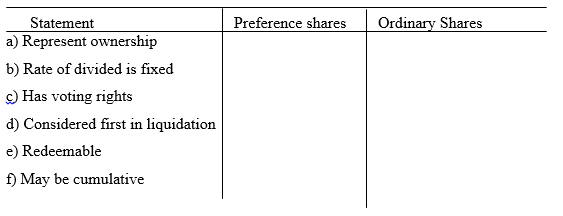

Explain five problems that farmers encounter when they sell their produce through marketing boards. (10 marks) 1995 P2 Outline 5 circumstances under which the government may find it necessary to nationalize an industry. (10 marks) 1996 P1 State five advantages of sole proprietorship form of business (5 marks) 1996 P2 Explain five sources of short term finances available to a business organization. (10 marks) 1997 P1 State four advantages of a partnership over a sole –proprietorship. (4marks) 1997 P2 Currently the government of Kenya is involved in privatizing public corporations. Explain five reasons that could make the government retain some of the corporations. (10 marks) 1997 P2 Describe five disadvantages of running a business as a sole proprietor (10 marks) 1998 P1 Highlight benefits an investor gets by buying debentures. (4 marks) 1998 P1 Highlight four benefits of joining a savings and credit co – operative society. (4 marks) 1998 P1 State four advantages of a hawker over a shopkeeper. (4 marks) 1999 P1 Highlight four factors that may have hindered the growth of co-operative movements in Kenya. (4 marks) 1999 P2 Explain five reasons why a public limited company may prefer to raise finance through issue of ordinary shares instead of debentures. (10 marks) 1999 P2 Outline the differences between a private limited company and a public corporation. (10 marks) 2000 P1 In the spaces provided below, indicate with a tick whether each of the following statements related to preferences or ordinary shared. (3 marks) 2000 P1

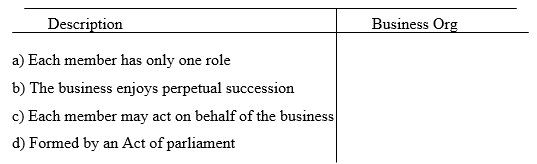

Outline four features of a sole proprietorship form of business organization (4 marks) 2000 P2 In what ways do multinational corporations differ from locally owned firms. (10 marks) 2001 P1 Outline four features of trade credit as a source of finance (4 marks) 2001 P1 State four reasons why a government may find it necessary to nationalize some industries. (4 marks) 2001 P1 In the spaces provided name the type of business organization described by each of the following features. 2001 P1

Outline four measures that can be taken to improve efficiency of parastatals in Kenya. (4 marks) 2001 P1 Outline 4 reasons why the government may decide to nationalize some business enterprises. (10 marks) 2001 P2 Explain the factors that make it difficult for many Kenyan to purchase houses through building societies. (6 marks) 2002 P1 Outline four ways in which a savings and credit co – operative society can raise capital. (4 marks) 2002 P1 Outline four features of a private company (4 marks) 2002 P2 Draw five differences between public limited company and a partnership form of a business. (10 marks) 2003 P1 Outline four features of a private company (4 marks) 2003 P1 List four sources of short – term finance for a business enterprise (4 marks) 2003 P2 Describe the problems associated with a sole proprietorship form a business (10 marks) 2003 P2 Explain six benefits that a company would get by raising capital through sale of ordinary shares (12 marks) 2004 P2 Wafula who recently retired would like to invest his retirement benefits in either of two business options. Explain five factors that Wafula should consider in choosing the business to invest. (10 marks) 2006 Q1 P1 State four advantages of operating a partnership form of business. (4 marks) 2006 Q3 P2 a) Explain five benefits that may accrue to a community that is involved in trading activities. (10 marks) b) Outline five benefits that a Savings and Credit Cooperative society (SACCO) provides to its members. (10 marks) 2007 Q21 P1 Highlight four ways in which the running of public corporations may be improved. (4 marks) 2008 Q2 P1 Outline four features of a Private Limited Company. (4 marks) 2008 Q1a P2 a) Explain five features that differentiate a Public Limited Company from a partnership form of business. (10 marks) 2009 Q24 P1 Outline four benefits that accrue to the government as a result of privatization of public enterprises (4 marks) 2009 Q1a P2 (a)Explain five features of sole proprietorship form of business (10 marks) 2012 Q2 P1 State four benefits that a farmer may derive from being a member of a producer Cooperative. (4 marks) 2012 Q3 P1 Highlight three benefits of globalization to a business enterprise (3 marks) 2012 Q6a P2 (a) A school leaver plans to start a retail business. Explain five types of small scale retail shops the person may start. (10 marks) Topic Objectives

gUIDELINES ON TOPICS8.00 FORMS OF BUSINESS UNITS (30 LESSONS)

8.20 CONTENT 8.21 Business units a) Sole proprietorships b) Partnerships c) Co-operatives d) Private companies e) Public companies f) Public corporations g) Parastatals 8.22 Features of each form of business unit 8.23 Formation and management of each form of business unit 8.24 Sources of capital for each form of business unit 8.25 Role of stock exchange market as a market for securities 8.26 Advantages and disadvantages of each form of business unit 8.27 Dissolution of business units 8.28 Trends in business ownership e.g. a) Globalization b) Amalgamation/mergers c) Privatization |

Business Studies Notes Form 1 - 4

Categories

All

Archives

April 2024

AuthorAtika School Team |

||||||

We Would Love to Have You Visit Soon! |

Hours24 HR Service

|

Telephone0728 450425

|

|

8-4-4 materialsLevels

Subjects

|

cbc materialsE.C.D.E

Lower Primary

Upper Primary

Lower Secondary

Upper Secondary

|

teacher support

Other Blogs

|

RSS Feed

RSS Feed